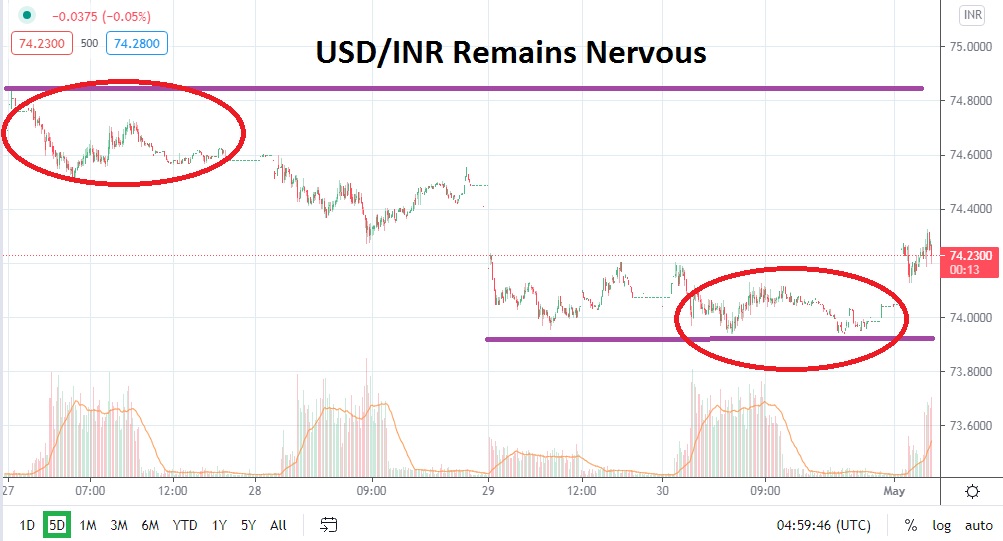

Late last week, the USD/INR was able to break below the 74.0000 support juncture momentarily. However, as trading opened early this morning, the USD/INR has gapped slightly higher and is near the 74.2200 mark as of this writing. The USD/INR remains within the lower depths of its short-term range and the Forex pair has proven that bearish sentiment remains a feature of its trading landscape, but nervous conditions also remain steadfast.

Speculators who are technically inclined and do not like to take into consideration outside influences, may not want to consider the news coverage which continues to paint a rather uninspiring outlook regarding the surge of coronavirus hitting India. However, the USD/INR still is likely being affected by the influence of sentiment being generated by the reports concerning the outbreak.

The USD/INR, importantly, is trading below lows seen on the 28th of April, and its price action has been rather narrow today after opening with the jump higher in the Forex pair. Support for the moment is near the 74.1300 level, which is where the USD/INR essentially opened for trading this morning. If this support level is challenged and the price breaks below this mark, traders cannot be blamed for believing an additional cycle of downward momentum could be demonstrated.

Considering the nervous trading landscape of the USD/INR, traders may want to consider the old adage of buy the rumor and sell the fact. Technically, the USD/INR does appear to have been overbought when news regarding the ‘new’ surge of coronavirus began to emerge a few weeks ago, but perhaps calmer waters will continue to prevail like they did last week.

Traders should be wary for the potential of volatility coming into the USD/INR, but today’s opening price action may actually prove to show that bearish sentiment has some additional ground to cover. The slight move higher was not able to puncture important short-term resistance from last week, and speculators may want to try and sell the USD/INR with the notion that the 74.0000 juncture may be tested again near term. Traders certainly should stay alert and keep in mind the potential for developing news to fluster the USD/INR, but this may prove to be temporary storms as downward momentum continues to prove stronger.

Indian Rupee Short-Term Outlook:

Current Resistance: 74.3450

Current Support: 74.1200

High Target: 74.5700

Low Target: 73.9800