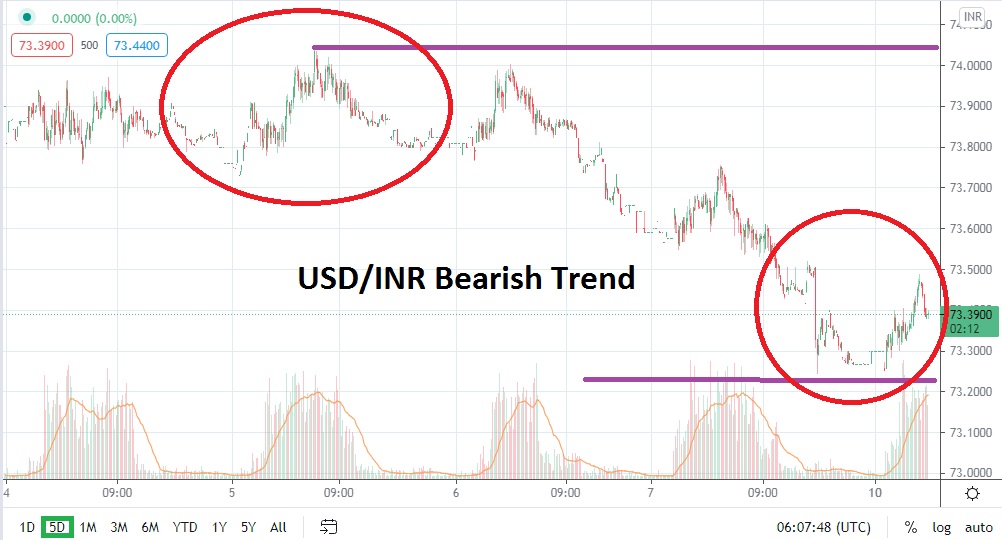

The USD/INR has sustained its bearish trend and has made support levels appear vulnerable as perceived junctures have been brushed aside rather easily. In early trading this morning, the USD/INR has traded slightly higher, but last week’s support levels are today’s resistance levels. Speculators who favor more downward price action from the Forex pair may believe that momentum will become re-energized after this morning’s climb higher to rather tranquil-looking technical values.

The USD/INR is now within sight of important early April prices, which were experienced before a wave of risk-averse sentiment struck when concerns regarding a new wave of coronavirus began to make an impact on the 7th of the month. As of this writing, the 73.4100 juncture is being explored and, if this ratio is sustained, it could be a signal that the 73.3500 to 73.2700 levels may become a legitimate target for traders.

The trading pace of the USD/INR remains quick and volatile. The rather swift downward trend within the Forex pair since the 3rd of May underscores technically and fundamentally that there seems to be a belief that higher values from the first week in April until the end of the month were a reaction to fears regarding coronavirus. The counter trend which is being seen now may have additional room to roam.

Resistance levels above can certainly be used by traders who believe there will be a natural cycle higher which will follow the bearish trend which has now developed. However, for speculators to take advantage of a higher move, they will have to be extraordinarily alert and use limit orders to get in and out of the USD/INR to cash out winnings before other potential downward moves are triggered. From a risk/reward scenario the USD/INR appears to have the potential to explore lower values with a more significant force.

If early April values are challenged short term, traders may see rather fast trading ignite, which could knock out more support levels. No, the USD/INR is not guaranteed to move in one direction; the bearish momentum could cease if sentiment somehow shifts. However, traders cannot be faulted for believing that additional selling of the USD/INR is going to be demonstrated. Conservative traders may want to wait for slight moves higher, which will then let them aim for nearby support levels which could be tested in the short term.

Indian Rupee Short-Term Outlook:

Current Resistance: 73.5300

Current Support: 73.3200

High Target: 73.7000

Low Target: 73.0900