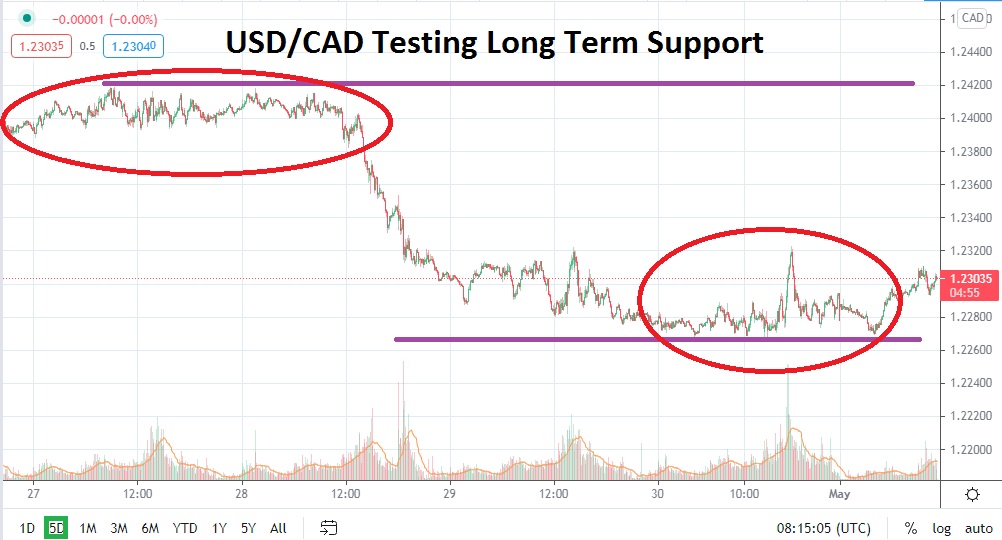

The USD/CAD continues to prove its bearish momentum is for real and speculators who have been wagering against the Forex pair’s trend have likely found it a costly adventure. Since the middle of last week, the USD/CAD has moved from a mark of nearly 1.24800 to its current vicinity of approximately 1.23000 with fast market conditions persisting.

Technical traders need to find long-term charts to contemplate the potential moves the USD/CAD can make if bearish momentum remains abundant. The last time the USD/CAD traded its current values was in January of 2018, and the largest amount of trading using the existing price was actually in September of 2017.

Some speculators who look at short-term charts may believe that now is the time to look for reversals higher. While that could prove an interesting short-term wager, the mid-term and long-term trends of the USD/CAD beg to argue via technical ratios. Traders should also consider the powerful addition of rising commodity prices and acknowledge that Canada’s economy is based in many respects on the export of its physical resources.

Short-term traders should certainly use limit orders when trading the USD/CAD because of the rather fast-trading landscape. Cautious traders may want to use momentum limit orders below current prices to chase further downside price action, but this could prove a mistake because the USD/CAD is already trading within its lower depths. It may be more practical for speculators to wait for slight reversals higher and seek bearish moves via their selling orders. The current price of 1.23000 could serve as an important inflection point and, if values are sustained below this level near term, it may be a signal that further downside can be anticipated.

The 1.22700 to 1.22500 junctures as support appear to be important short term. Speculators may point out that reversals frequently occur after volatile moves are made. However, looking for upside price action in the USD/CAD does appear to have technical risk/reward ratios against it, because of the strong bearish trend which has maintained its pace. Traders should be careful not to over-leverage their positions and be willing to cash in winning trades, but remaining a seller of the USD/CAD appears to be correct decision near term.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.23200

Current Support: 1.22700

High Target: 1.24100

Low Target: 1.21000