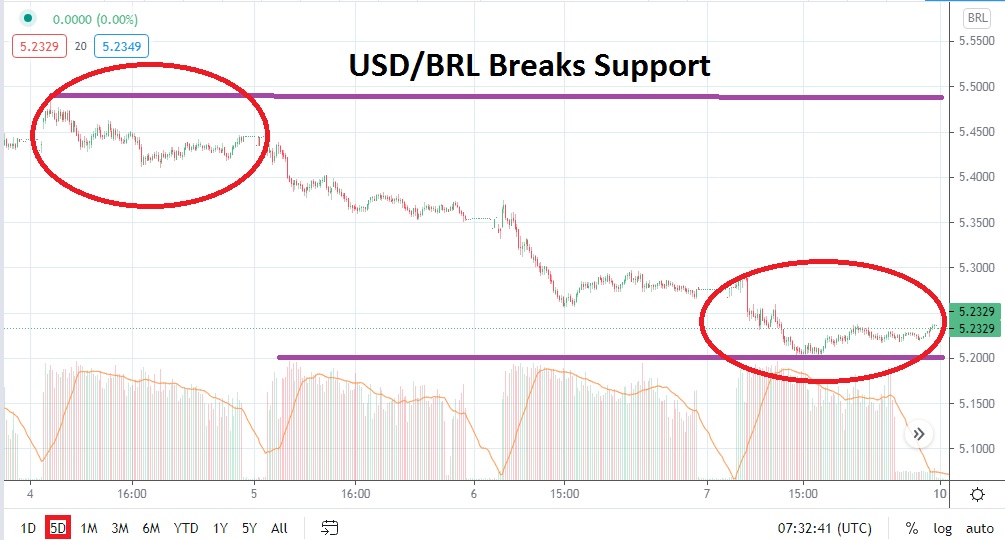

The Brazilian real has officially begun to trade like many other major currencies as it technically correlates against the USD. Important mid-term support levels have been punctured and the USD/BRL is now trading near lows last seen the third week of January. As of this writing, the USD/BRL is near the 5.2300 ratio. Upon opening this morning, many other major currencies paired against the USD experienced slight bullish moves, but this is likely a natural reaction to the strong bearish momentum that was displayed late last week.

The ability of the USD/BRL to break through the 5.4000 juncture in May and sustain its value below, and then test the 5.3300 level and puncture it late last week is significant. Speculative bearish traders who have been pursuing downward momentum within the USD/BRL were likely rewarded the past couple of days. The USD/BRL has gone from a price of nearly 5.7500 on the 13th of April to its current lows, which have it within sight of low water marks seen in January.

If the USD/BRL can now challenge support levels near the 5.1800 ratio, this would put it within proximity to December 2020 values. The month of December essentially produced a range of 5.2000 to 5.0200 with an abundance of its trading taking place within the 5.1000 to 5.1800 prices. The last time the USD/BRL traded below the 5.0000 mark in a serious manner was in June of 2020, when it tested a low of 4.8200 on the 8th of that month.

The USD/BRL has been challenging for many speculators the past months because it has not correlated with many other major currencies in an easy manner. However, since late February, it can be argued the Brazilian real has technically started to dance in step with global Forex markets. Short-term traders may now be looking at the USD/BRL and wondering if it has achieved too much within the bearish trend it is enjoying.

Conservative traders may want to wait for slight moves higher so they can activate selling positions of the USD/BRL. Yes, the USD/BRL is near important mid-term support levels, but its trend may remain bearish and there may be further depths below to test for aggressive traders.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.2700

Current Support: 5.1880

High Target: 5.3500

Low Target: 5.1300