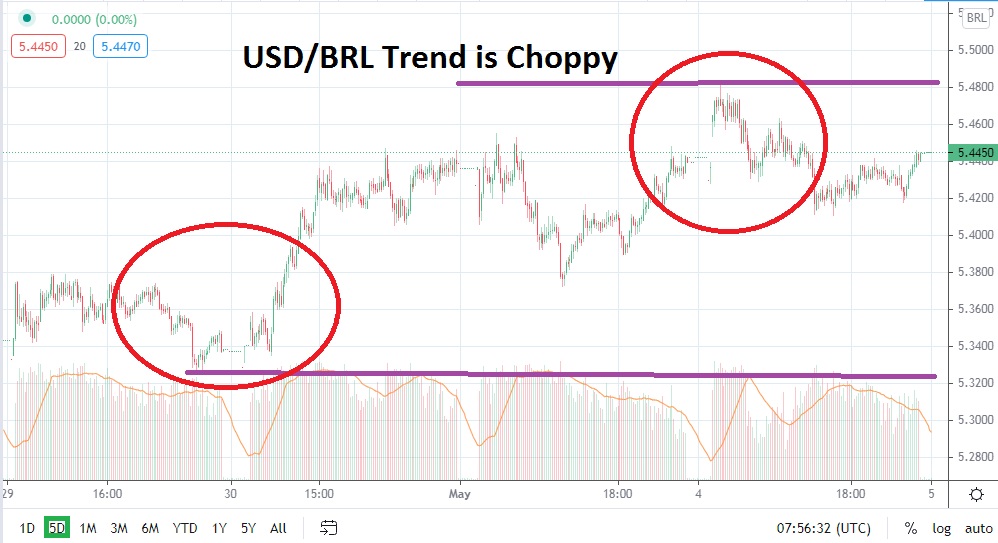

The USD/BRL has been able to traverse into the lower part of its mid-term range since March, but this has not come without a fight. After hitting a high of nearly 5.8800 on the 8th of March, the USD/BRL has been able to fight its way downward. However, short-term traders remain challenged by the hard-to-grasp price movements of the USD/BRL because of rather choppy results, which are full of reversals and likely cause nervous reactions within inexperienced speculators.

One way to battle the rather seesaw price movements of the USD/BRL is too make sure a conservative amount of leverage is being used. Another aspect which needs to be practiced within the USD/BRL is patience, because the Forex pair has a limited area it will typically traverse in one day, sometimes within a week. Traders need to understand wagering on the USD/BRL is often not a one-day outcome. Yes, there are certainly other perspectives which can be offered; obviously, if a large amount of leverage is used, this means that incremental price changes will produce rapid results.

Technically, the 5.4000 to 5.5000 junctures have become important and the consolidated movements within the USD/BRL can be gauged within this sphere. If traders want a quick-hitting trade, it may prove to be wise to decide on price direction. Currently, when looking at the USD/BRL within a mid-term perspective, it can be said a bearish trend exists. However, support levels have produced frequent reversals higher. Therefore, selling the USD/BRL on slight moves higher may remain a worthwhile wager.

In order to sell the USD/BRL on moves higher, traders can place limit orders above current market prices and input the value they want to short the Forex pair. Depending on the amount of leverage a speculator is using and the results hoped for, a time period for conducting the trade should also be factored before placing the trade.

Yes, all speculators want one-hour quick trades which produce profits, but the USD/BRL has a habit of moving in a rather incremental pace. Take-profit orders should be selected and implemented too, so profits can be quantified into cash winnings. There is a chance your limit orders may not get filled if they are too far away from market price action too.

The USD/BRL remains troublesome as its range continues to produce rather consolidated short-term movements. Support and resistance levels have grown closer from a technical perspective and traders should choose their price targets wisely. From a specualtive point of view, selling the USD/BRL on slight rises and tests of current resistance levels looks like the best wager.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.4697

Current Support: 5.4190

High Target: 5.4850

Low Target: 5.3980