The S&P 500 initially tried to rally during the trading session on Wednesday, only to give up early gains and form a less-than-attractive candlestick. The market continues to see plenty of support underneath, though, so I think it is only a matter of time before buyers re-enter this market. For starters, the Federal Reserve continues to throw liquidity at the market hand over fist, and that will keep stock markets going higher due to the fact that “there is no other alternative” according to a lot of Wall Street pundits.

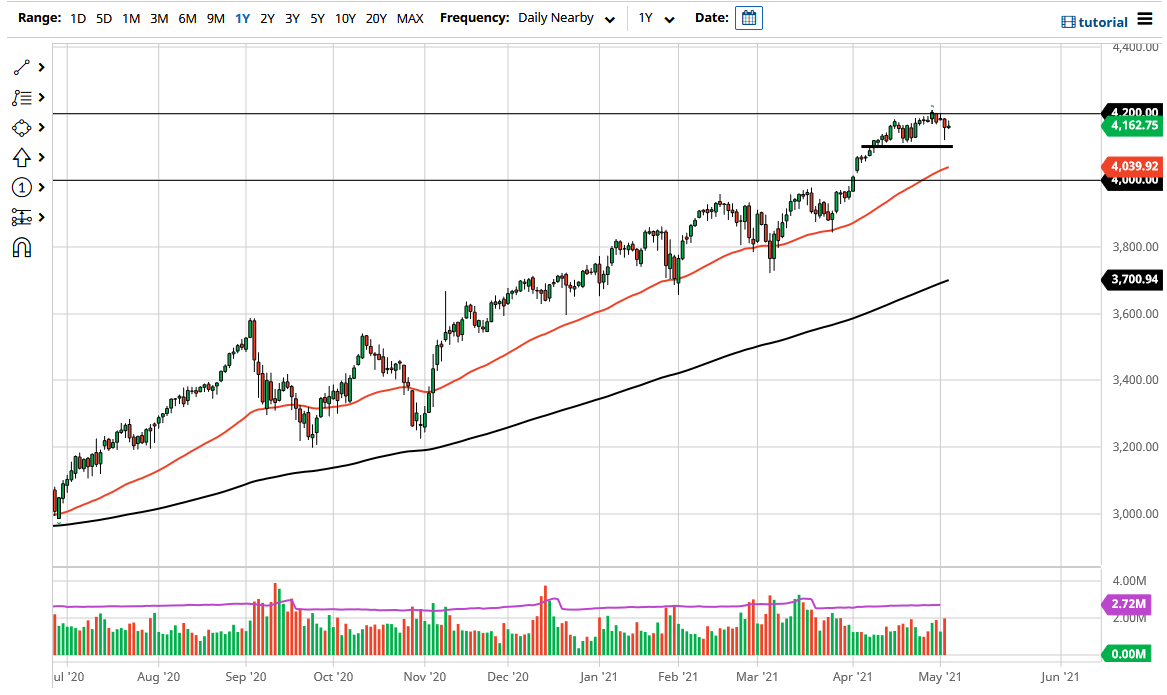

Underneath, the 4100 level should offer plenty of support, just as the 50-day EMA will if we break down below there. What I find particularly compelling about the 50-day EMA is that we continue to see it as dynamic support, but furthermore, we also have plenty of support underneath at the 4000 level. There is a gap sitting just above the 4000 level that also comes into play, so it is likely that we will see a certain amount of buyers in that area. In fact, I would be very surprised to see the market break down below there, but if it does, then we probably would go looking towards the 200-day EMA underneath.

To the upside, if we get a daily close above the 4200 level, it is likely that we could continue the uptrend and go looking towards the 4400 level based upon the 200-point increments that this market tends to move in. I think that probably has to wait until we get the jobs number on Friday, and I would anticipate that the Thursday candlestick will probably show a lot of back and forth and sideways action. The market has lost a lot of volatility, so it is simply killing time between now and 8:30 AM on Friday. That being said, there is always the possibility of some type of headline crossing the wires to get people moving, but at this point it seems like it is all about the jobs number. Furthermore, the Friday session will probably be very volatile, due to the fact that estimates for the jobs number are all over the place from an addition of 600,000 jobs all the way to an addition of 2 million.