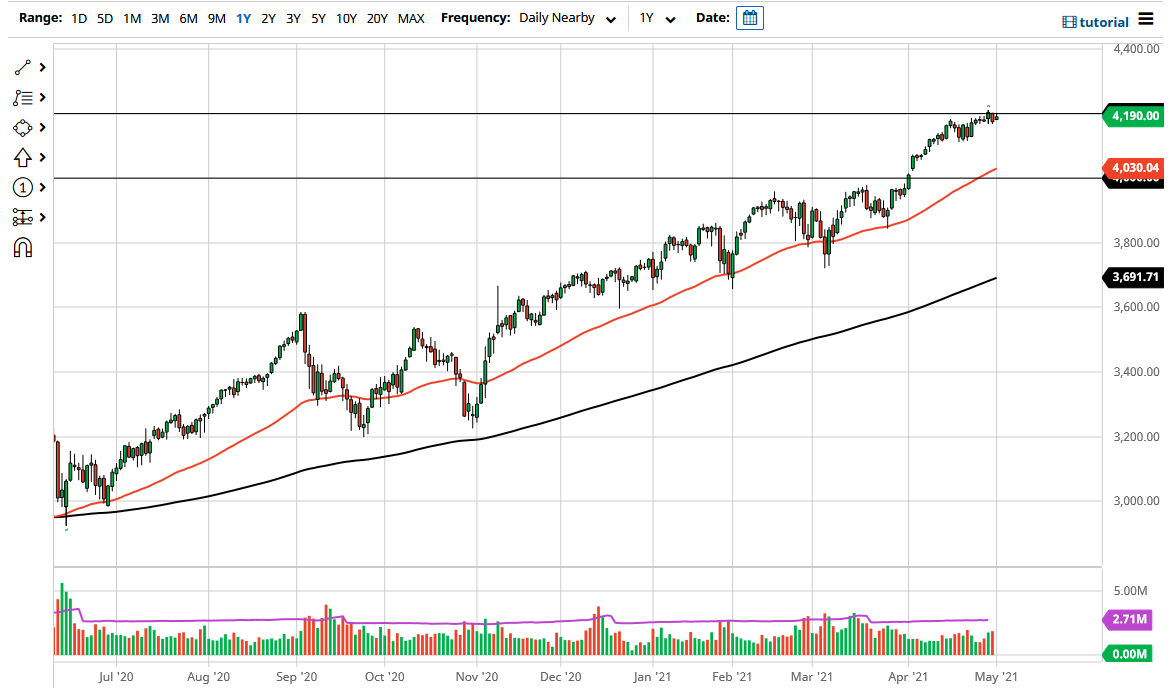

The S&P 500 has gone back and forth during the trading session on Monday as the 4200 level continues to keep a lid on the market. We are going to kill time between now and Friday, as the jobs number will be coming out and some of the estimates have been for an addition of over 2 million jobs. In other words, it is difficult to imagine what the overall reaction will be, because it would not take much to disappoint.

However, we all know that the Federal Reserve will do whatever they can to keep the market going forward, and the narrative on Wall Street is almost always one that is bullish. Because of this, you buy dips and do not short the market, unless you can somehow time a sudden collapse, but that is a fool’s game. This is a one-way trade, and that is by design. Keep in mind that the S&P 500 is not equally weighted, so it is only a handful of stocks that need to move to the upside in order for this market to rally. It is all of the stocks that everybody trades, such as Tesla or Microsoft.

The 4100 level underneath is an area that could offer a bit of support, but it is minor in its scope compared to the 4000 level underneath that now features a gap and the 50-day EMA just above it. With that in mind, I think it would only be a matter of time before the buyers would get involved on a value proposition, buying the market as it becomes “cheap.” Furthermore, the Federal Reserve is almost certainly going to make some type of statement saying that they are going to keep the interest rates at artificial low levels, in which case the more likely it is that the stock market is going to continue to go higher.

Longer term, this is probably a major issue, but at the end of the day, financial instability is something that we all are starting to learn to live with. It is almost as if the market going higher over the longer term is something that we are aiming for and are willing to put up with the occasional tantrum that wipes out 20% of its value. In other words, when you look at the chart, we have the sudden meltdowns, but at the end of the day if you just simply buy and hold you make money. So, if you are going to be a trader, you should only be looking in one direction.