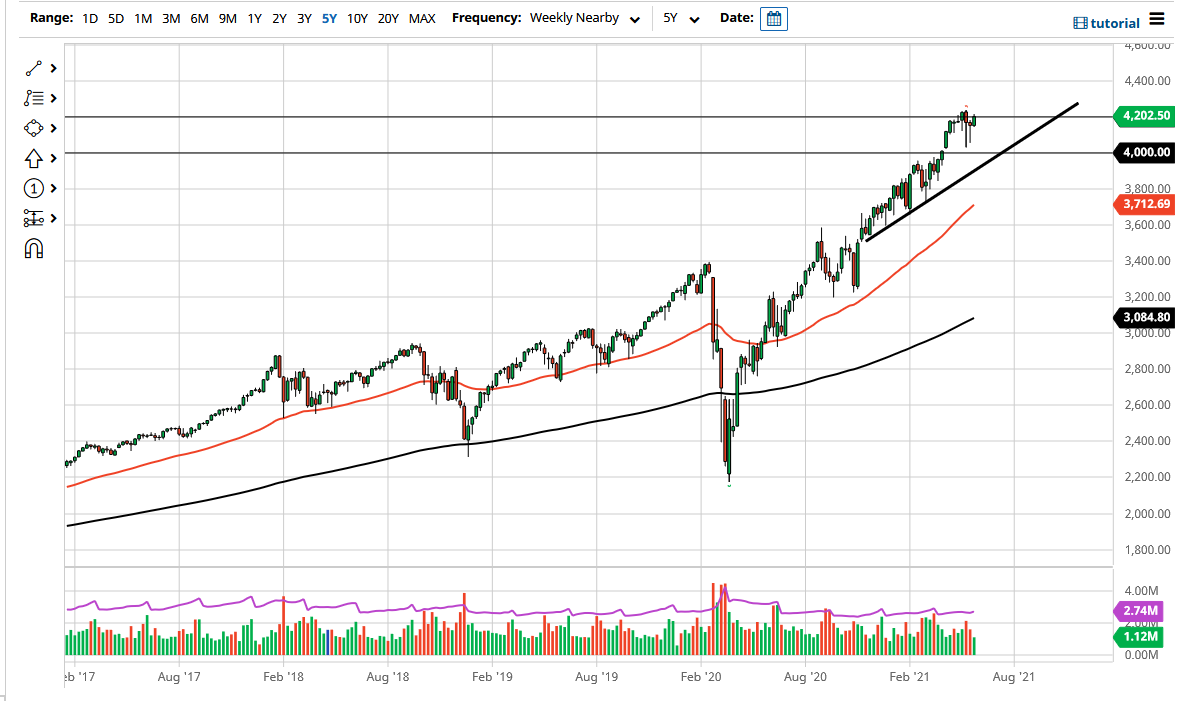

The S&P 500 has been a bit choppy during the month of May, but as we head into June, it looks as if we are going to try to take off to the upside. The market has closed the market near 4200, an area that has been the previous resistance, and it does look like we are going to try to break above there. If we do, then it opens up more of a “buy-and-hold” type of scenario, perhaps with an eye on the 4400 level. Remember, I have stated multiple times that the S&P 500 does tend to move in 200-point increments, and I do not see anything coming up that would change this.

It is also worth noting that the last couple of candlesticks have been hammers, which typically means that there are plenty of buyers for the dips going forward. This makes sense, because there is a major liquidity push to the upside in general, and I do not see that changing anytime soon. Ultimately, this is a market that continues to look bullish in general, and it certainly has a lot of support built in underneath at the 4000 handle from not only a psychological standpoint, but also because of the fact that there is still a gap underneath there that could come into play.

At this point, unless we break down below the 4000 level, it is difficult to imagine a scenario where the market gets overly bearish. Granted, this time of year does tend to be somewhat choppy, but at the end of the day I do believe that the buyers will continue to pick up this market if for no other reason than simple habit. After all, there is plenty of central bank liquidity and intervention globally to support the markets. Beyond that, fears of inflation had people buying assets in order to protect wealth, so that will have a somewhat positive effect on the markets as we have seen over the last 13 years. At this point, if we were to break down below the 4000 level, and perhaps that trendline that I have drawn, I might buy puts, but I think it is only a matter of time before somebody would come in - perhaps Jerome Powell - and make an announcement to save the market via liquidity yet again.