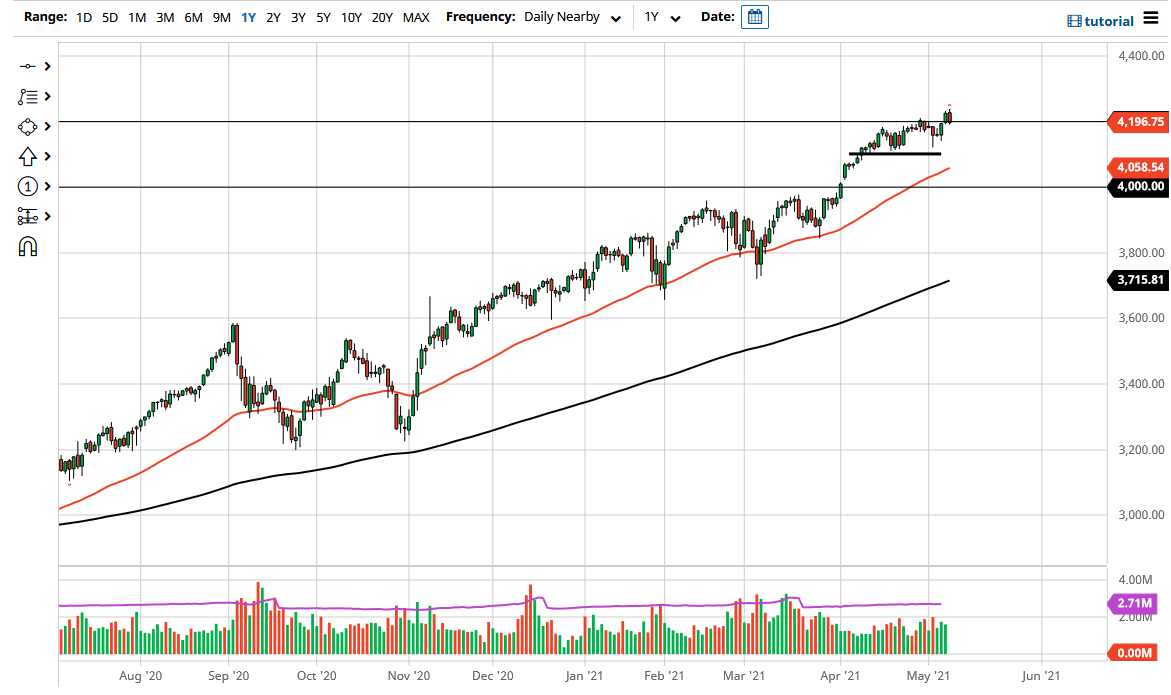

The S&P 500 initially tried to rally during the trading session on Monday but gave back the gains to fall towards the 4200 level. This is an area that was a significant breakout, so it will be interesting to see how this plays out. In theory, there should be a significant amount of support in this area, so we will have to wait and see whether or not this market bounces. If we do see a bounce from here, then I think that is a nice buying opportunity. Underneath there, we have the 4100 level which has been supportive more than once and I think it is an interesting place as well.

The size of the candlestick is not necessarily something that I am overly concerned about, so I do not think this is going to be anything along the lines of a trend change. The question at this point is not so much as to whether or not the trend has changed, but whether or not we are going to pull back to this level, or one below it. If we break down below the 4100 level, then I think the gap just above the 4000 level makes the most amount of sense. The 50-day EMA sits just above there as well, so I think that could come into play also.

The 4000 level has a gap that would be crucial, so if we were to break down below there it would likely open up a flood of selling in this market, perhaps sending the S&P 500 down to the 3800 level. The 200-day EMA seems to be racing towards that region, so I think that also is another reason to believe that the buyers would be involved. Breaking down below that level would signify a major turn of events and a trend change. At this point, I might be a buyer of puts, but I would not short this market due to the fact that the Federal Reserve will do everything it can to keep the liquidity flowing into this market. If that is going to be the case, then we are going to continue to see more of a “buy on the dips” type of mentality as the S&P 500 still has a nice trajectory to the upside.