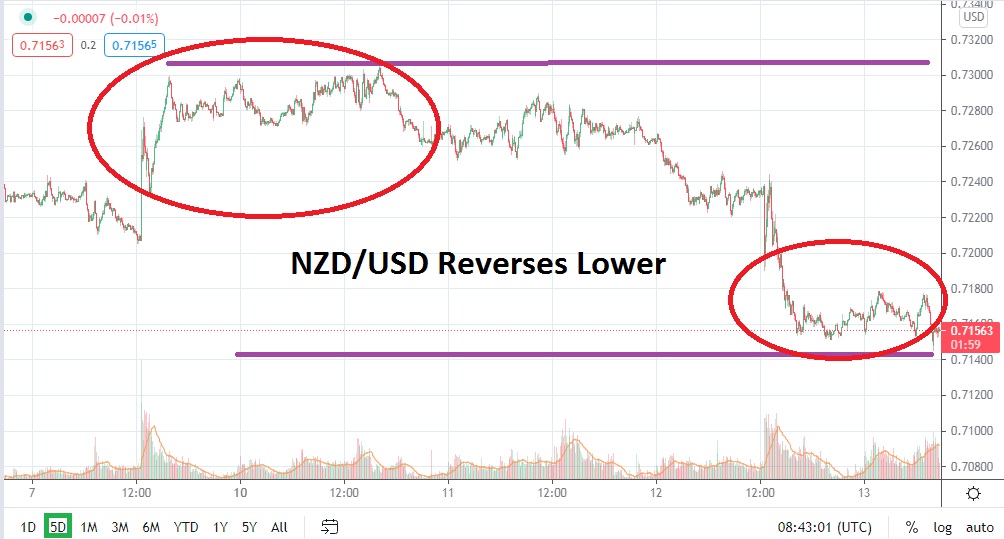

If a trader happened to take the past month off from speculating and is returning to the Forex markets today, they could not be blamed for believing that nothing much has happened within NZD/USD over the past handful of weeks. However, they would quickly discover that technical charts have proven them wrong and that significant price action with strong reversals has been demonstrated within the Forex pair.

As of this writing, the NZD/USD is trading near the 0.71500 mark, but this price is being demonstrated only three days after a one-month high of nearly 0.73000 was approached on Monday. On the 4th of May, it needs to also be pointed out, the NZD/USD was trading near a low of 0.711400. Speculators on the New Zealand dollar should understand that the potential for volatility is always present.

Significant support near the 0.71300 level should be watched short term. If this support level manages to hold back the sudden emergence of bearish momentum within the NZD/USD it could certainly spark another wave of buying. Global Forex markets have proven choppy the past day-and-a-half as concerns regarding investor sentiment are clearly being seen. If current support levels fail to hold off another selling storm, traders cannot be faulted for believing the 0.71200 level could a target.

Curiously, the NZD/USD is within the middle of its mid-term price range. A high of nearly 0.74650 was produced on the 25th of February, which quickly witnessed a reversal lower and a mark of 0.71000 was tested in the first week of March. From the 23rd of March until the middle of April, the price range for the NZD/USD was mostly between 0.71000 and 0.69450. But since the 14th of April, the NZD/USD has not traded significantly below the 0.71200 mark.

As the NZD /USD trades near its current values, traders may believe that support levels will prove worthwhile as a spot to activate buying positions of the NZD/USD. However, it may prove more practical to use the lower support levels as a stop loss ratio, and actually buy the NZD/USD if it is able to sustain its current price above and near the 0.71525 to 0.71450 junctures on small moves lower. The volatile price action of the New Zealand dollar means traders should use limit orders, but they also sometimes need to be a bit aggressive to participate in the NZD/USD.

NZD/USD Short-Term Outlook:

Current Resistance: 0.71850

Current Support: 0.71300

High Target: 0.72180

Low Target: 0.71100