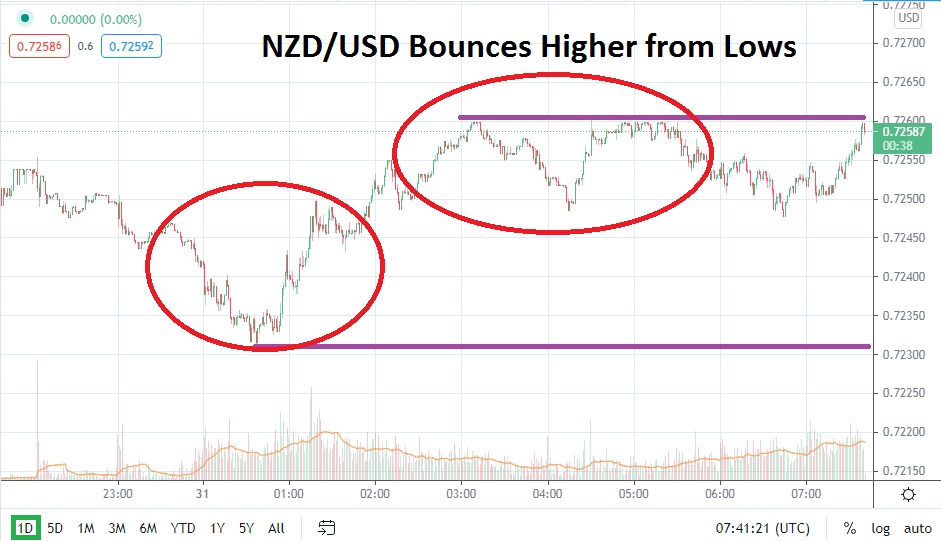

The NZD/USD continues to prove it has the ability to remain fixated near important higher values, even as it faces the occasional reversal lower. As of this morning, the NZD/USD is trading near the 0.72550 level, and the 0.72100 mark is proving to be rather durable as support in the short term. Intriguingly, the NZD/USD is again within sight of the 0.73000 juncture, which has proven to ignite reversals lower the past few months.

Since reaching a high of 0.74600 on the 25th of February, the NZD/USD has not been able to muster a serious attack on this higher value. After reaching this fast and high water mark, the NZD/USD has certainly been tested with severe reversals. On the 1st of April, the NZD/USD was trading near a low of nearly 0.69500. However, reversals higher have been steady as the New Zealand dollar has recovered its higher price range and now the 0.73000 juncture stands out as a target again.

Since the beginning of May, the NZD/USD has seemed to have received a large amount of support near the 0.71300 to 0.716000 ratios. The past month of trading has produced a test of highs slightly above the 0.73000 price with resistance in many cases actually being around the 0.72700 barrier predominantly.

Late last week’s price action did see the NZD/USD trade above the 0.73000 juncture on a couple of occasions but suffer a reversal lower. However, curiously, the NZD/USD has also produced solid support technically around the 0.72500 to 0.72100 junctures and this may indicate that the next time the NZD/USD makes a push higher, it may enjoy sustained momentum.

While the bullish trend of the NZD/USD certainly remains intact, the resistance level of 0.72700 should be watched closely. If this nearby mark proves vulnerable and value is sustained above, traders may believe that another test of the 0.73000 juncture is going to develop sooner rather than later. Conservative traders may want to wait to buy the NZD/USD on slight pullbacks which test support levels below. Short term, the NZD/USD is showing signs of consolidation, and this may also add credence to the perception that additional bullish momentum is a possibility with the 0.73000 juncture as a legitimate target.

NZD/USD Short-Term Outlook:

Current Resistance: 0.72700

Current Support: 0.72300

High Target: 0.73120

Low Target: 0.72150