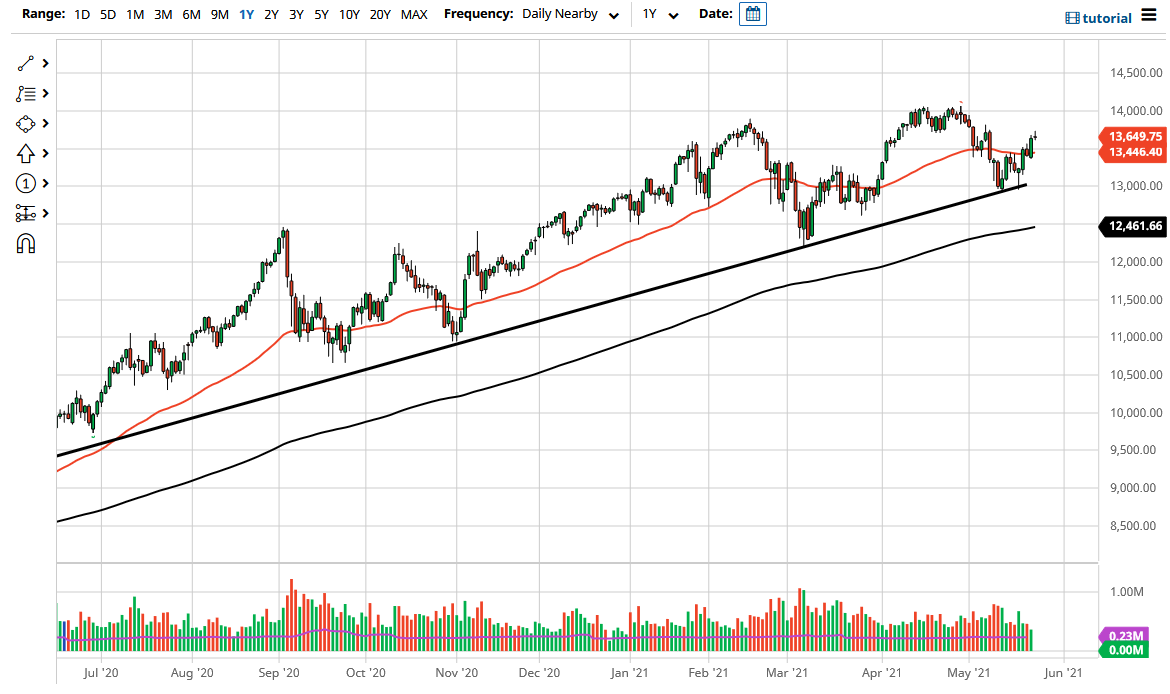

The NASDAQ 100 initially rallied during the trading session on Tuesday but gave back the gains in order to show signs of exhaustion. At this point, the market could very well pull back towards the 50-day EMA which is just below the 13,500 level, an area in which I have seen a bit of interest in both buyers and sellers. With that being the case, the market is likely to see a move towards the 14,000 level above which was the all-time high.

On a pullback from here, that 50-day EMA should be important, as a lot of people like taking advantage of it. The 50-day EMA also corresponds to the bottom of the impulsive candlestick from the previous session. Looking down below there then opens up the possibility of the uptrend line being targeted and the 13,000 level. With this being the case, the market is likely to see a lot of interest, as the technology stocks have been trashed recently. If the interest rates continue to fall, that does help these stocks, and they could continue to push to the upside.

To the downside, the uptrend line is something worth paying attention to, because if we do break down below there, then I think it does open up a little bit of negativity, perhaps down to the 200-day EMA initially. It is not until we break down below there that I would be a buyer of puts, as it could give you a bit of an opportunity to pick up some gains, but without the struggle of trying to fight the Federal Reserve and the latest headlines that could have people jumping in. At this point, the market is likely to continue to see a lot of volatility and manipulation, but I have no interest in shorting. With this, I look to find a way to limit my losses more than anything else. At that point, I believe that you would have to take your profits relatively quick, because if the markets do in fact fall apart, it is only a matter of time before the market would probably turn around. Therefore, I would be very cautious about doing that, hence the fact that I would be using options. In general, though, I like the idea of buying dips.