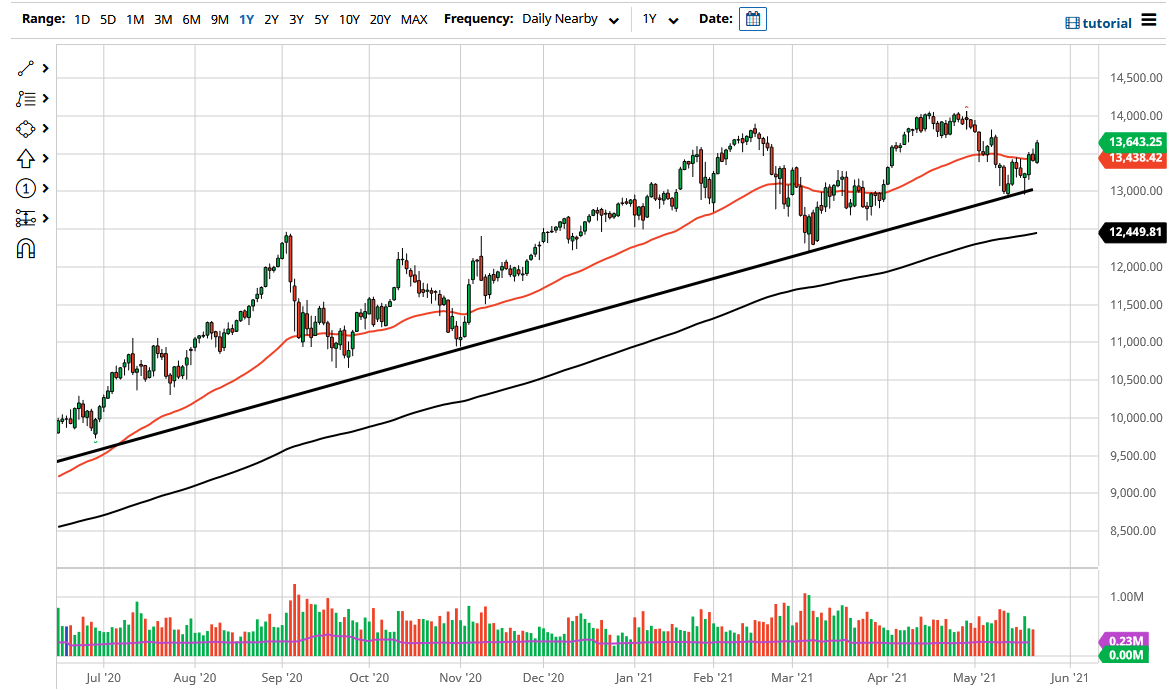

The NASDAQ 100 broke out to the upside to kick off the week, as we have cleared the top of the 50 EMA region, which has been important more than once. At this point, we are also above the 13,500 level, which is something that is worth paying close attention to. The NASDAQ 100 does tend to take its cues from 500-point levels, which we have clearly smashed through during the trading session on Monday.

If we can break above the top of the candlestick for the trading session on Monday, then it could open up a move towards the 14,000 level, which is a large, round, psychologically significant figure, and perhaps even more importantly, is the all-time high. If we can break above there, then the market is likely to go looking towards the 14,500 level, which is a 500-point range as well. Because of this, I think that eventually we do break out to the upside, but it might be a bit noisy in the short term.

The size of the candlestick is somewhat impressive, but perhaps the most important part is that we closed towards the very top of it. The NASDAQ 100 has been a little less than impressive lately, so I do think that is something worth paying attention to. At the end of the day though, this is a market that has been rallying over the last couple weeks and is in an uptrend when you look at the longer-term standpoint. Because of this, you certainly cannot be a seller, and I like the idea of taking advantage of the overall trend. The uptrend line at the 13,000 level should continue to be supportive as well, so with that being the case, I think it is only a matter of time before buyers take care of any dip as a potential value play. If we were to break down below the uptrend line, then I think the 200-day EMA would be the next target that people would be looking at for a potential turnaround. I have no interest in shorting this index, as US indices are far too manipulated by liquidity measures to try and make money doing that. If we do break down below the 200-day EMA then I might buy puts, but that is about as bearish as I get.