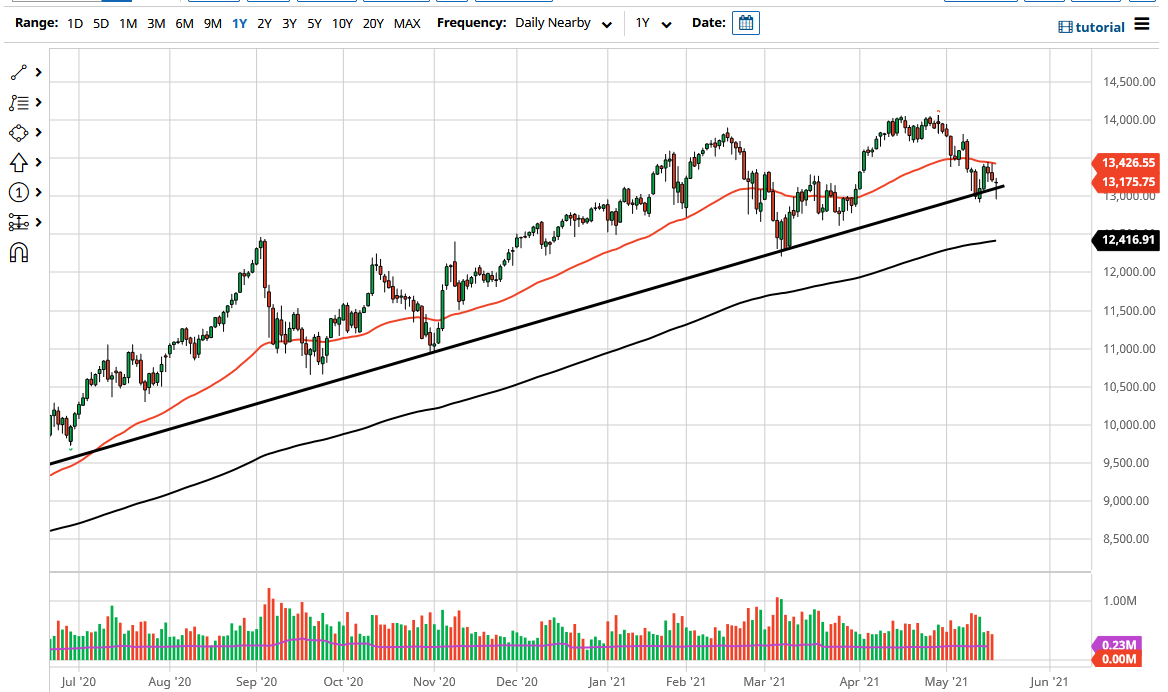

The NASDAQ 100 fell during the trading session on Wednesday as we have seen a lot of risk appetite get crushed during the day. That being said, we have bounced hard from the 13,000 level, which is a good sign that we will continue the overall uptrend. The 50-day EMA is above, and that could cause a little bit of a headache; but at the end of the day, I do not think it is a major issue. Furthermore, the uptrend line has held, so that is yet another reason to think that this market looks good. Remember, tech stocks have been hammered as of late so it might be a little bit noisy.

Interest rates in the United States have been rising, and that generally works against technology and other growth stocks. There has been a lot of churning and repositioning by portfolio managers, so that has caused some trouble. If we can keep interest rates under control in America, that will keep this market somewhat favorable.

Keep in mind that we have seen a nice pullback over the last several weeks, and value hunters could be coming back into the picture advantage of some of the big leading technology companies. Furthermore, people are worried about inflation so they are trying to do everything they can to get out of cash. While we have seen a little bit of frightening behavior during the session, at the end of the day not much has changed, and it looks like we are simply trying to build a base in this general vicinity to continue going higher. I do believe that if we can break above that 50-day EMA, we are more than likely going to go looking towards the 14,000 level. The 14,000 level being broken to the upside opens up the possibility of a much bigger move, probably to the 15,000 level which is my longer-term target. It does not necessarily mean that it is going to be easy to get there, but it certainly seems to be what we are reaching towards. I have no interest in selling, but if we were to make a fresh, new low, I would be a buyer of puts, as I would anticipate that the market goes looking towards the 200-day EMA underneath.