The NASDAQ 100 dropped a bit during the trading session on Friday as we continue to see 14,000 offering a significant amount of resistance. The 14,000 level is an area that has been very difficult to overcome, but as we are in the midst of earnings season, it should not be a huge surprise that we have seen a lot of noise at this point. Because of this, it has been more or less a short-term choppy type of market, but when you look at how we got here, it should not be a huge surprise that we had to work off some of the froth heading into the earnings season.

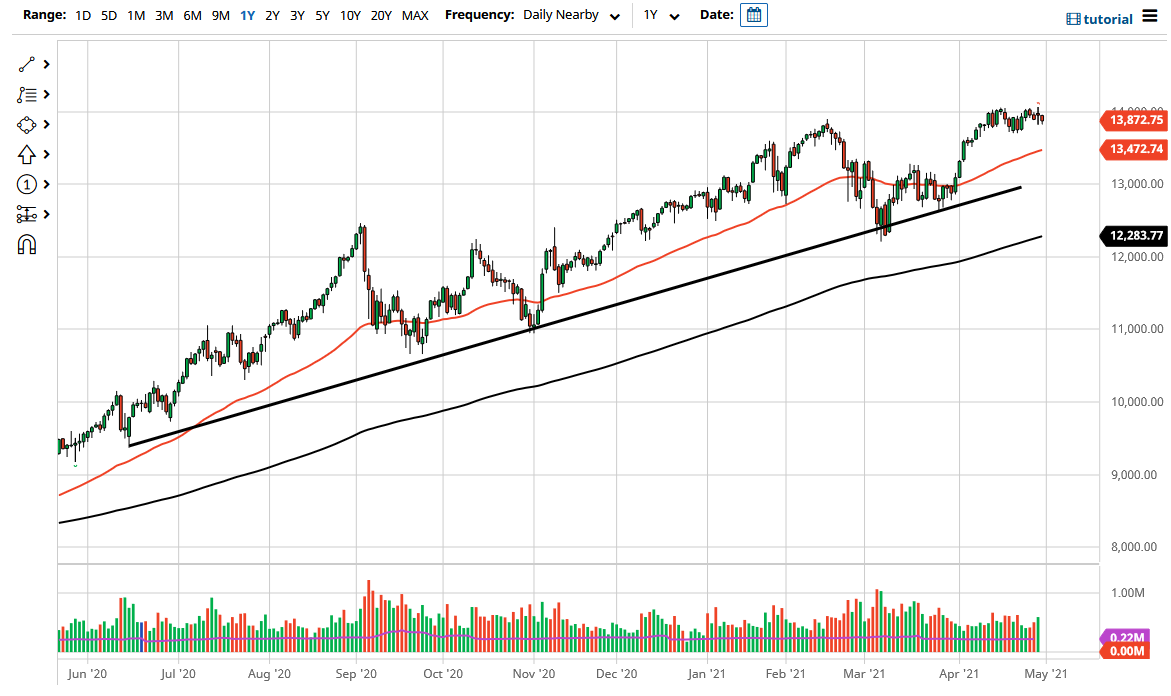

I think at this point in time it is very likely that we continue to see the 14,000 level as a very difficult to overcome, but once we do it is very likely that we will probably go looking towards the 14,500 level, possibly even the 15,000 level after that. It is possible that we could get a bit of a pullback between now and then, but the 50-day EMA will almost certainly come into the picture as well, right along with the uptrend line that sits underneath there. The big clue there is the phrase “uptrend line.” In other words, that is how you have to look at this market: one that is going higher.

With central banks out there flooding the markets with liquidity and the fact that the NASDAQ 100 is highly levered to just a handful of technology names, it is difficult to imagine that this market will fall for any significant amount of time. If we did break down below the uptrend line, roughly the 13,000 level, then I might be a buyer of puts, but there is no way that I would be remotely close to the idea of shorting this market.

Breaking to the upside is the most natural thing for this market to happen, but the question at this point in time is whether or not we need to pullback in order to build up the momentum? It does not really matter, I will simply either buy the breakout or some type of supportive candlestick on the daily chart. With that being the case, I am simply going to take a certain amount of patience to this market, but I am looking in one direction.