These gains of 1890 dollars per ounce, are its highest in four months. The yellow metal was exposed to profit-taking selling that pushed it towards the level of 1862 dollars an ounce as the US dollar recovered after the announcement of the minutes of the last meeting of the US Federal Reserve. The price of gold settles around the level of 1870 dollars an ounce at the beginning of trading on Thursday. Waiting for the investors' reaction to what was issued by the US Central Bank and what is happening in the cryptocurrency market. Global economies reopen activity and abandon Corona restrictions, despite the frightening situation in India.

The US Central Bank meeting minutes showed that the FOMC members were of the view that any price increases from bottlenecks are likely to have only "temporary effects" on inflation. The minutes also indicate that the Fed will not decrease or allow interest rates to rise anytime soon

In the same performance of gold, silver futures contracts fell to 28.025 dollars an ounce, while copper futures settled at 4.5765 dollars a pound.

Adding to the attention of forex traders, Bitcoin, the world's largest cryptocurrency, fell nearly 40% from its record highs to below $ 30,000 support, reaching its lowest level since February. Cryptocurrencies have fallen sharply after the Chinese Banking Union issued a warning about the risks associated with digital currencies. A statement posted on the industrial association's website stated that all members must "firmly abstain from conducting or participating in any commercial activities related to virtual currencies."

The Bitcoin tumble comes after longtime Bitcoin defender Tesla recently said it would no longer accept Bitcoin as payment for its cars, reflecting its previous position. The sale was so intense that the website for Coinbase, an online cryptocurrency broker, was down temporarily in the morning. Accordingly, Coinbase shares fell 5.9%, ending 34% below their April 16 peak, just two days after the initial public offering.

All in all, investors remain focused on whether the rise in US inflation is temporary or will continue. Prices for everything from gasoline to food are rising as the economy recovers from more than a year of distress. Accordingly, the Fed expects the rise in inflation to be temporary and linked to the recovery of the economy, but investors were still not sure and were more cautious. The fear is that the Fed will have to pull back from its broad support if inflation continues. This includes record low interest rates and a monthly purchase of $ 120 billion in bonds aimed at grabbing the job market and the economy.

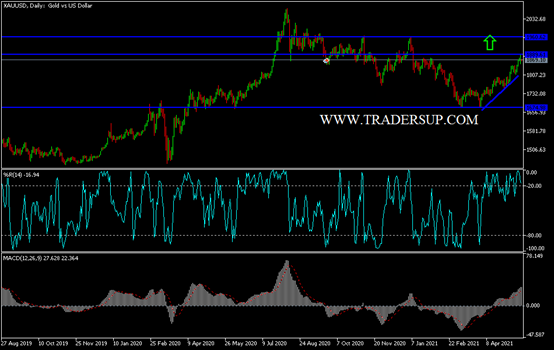

According to the technical analysis of gold: Although the dollar has recovered and the path of recent gold gains has stopped, the general trend of gold is still up, and as I mentioned before, the future psychological resistance of 1900 dollars will depend on the stability of the price of gold above the resistance of 1885 dollars per ounce. The move by the bears towards the support levels 1849, 1835 and 1820 is a strong and clear threat to the current uptrend. The price of gold will be affected today by the extent of investor appetite for risk or not, as well as the dollar's reaction to the US weekly jobless claims announcement and the reading of the Philadelphia Industrial Index