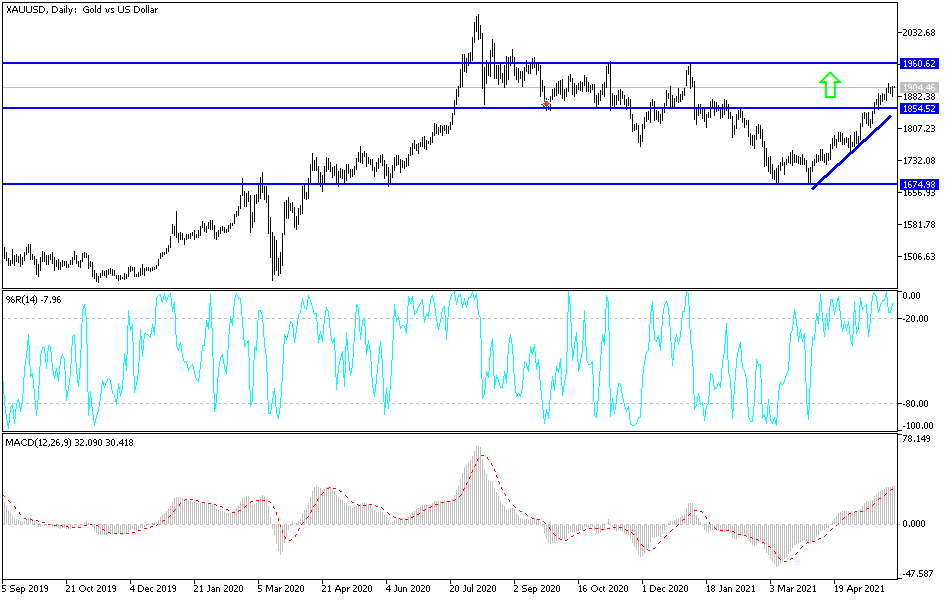

Gold markets initially fell during the trading session on Friday but then turned around to show signs of strength again. Towards the end of the day, we broke above the $1900 level again, an area that has a certain amount of psychology built into it due to the fact that it is a large, round, whole figure. After that, you can also take a look at the market in the past and how it has reacted to the $1900 level in both directions and surmise that it is important.

That being said, there is a lot of noise just above, and I think we need to clear the candlestick from Wednesday to the upside in order to see more momentum involved. At this juncture, I believe that the market is probably going to chop sideways with a slightly upward bias, as the $1900 level seems to be a bit of a magnet for price. With that in mind, I recognize that we could have a quiet couple of days.

However, with the jobs number coming on Friday and concerns about inflation (or maybe even the lack of) down the road, this will have its say when it comes to the gold market. Beyond that, we also have the US dollar and the negative correlation that we typically see in this marketplace. Adding all of that together suggests that we will probably have choppy behavior; but I still believe that the recent breakout is something that is worth paying attention to, so you most certainly should keep that in mind.

I have no interest in shorting this market, at least not until we break down below the previous downtrend line, which at this point is all the way down to the $1830 region. Furthermore, we also have the “golden cross” that formed several sessions ago and will attract a lot of longer-term money. Over the next several months, we could see this market go looking towards the $2100 level, but obviously there is a lot of work to do in order to get all the way to that level, which was the recent highs. I believe that this market will continue to see every $50 or so as a minor hurdle, so you can think of those as signposts along the way.