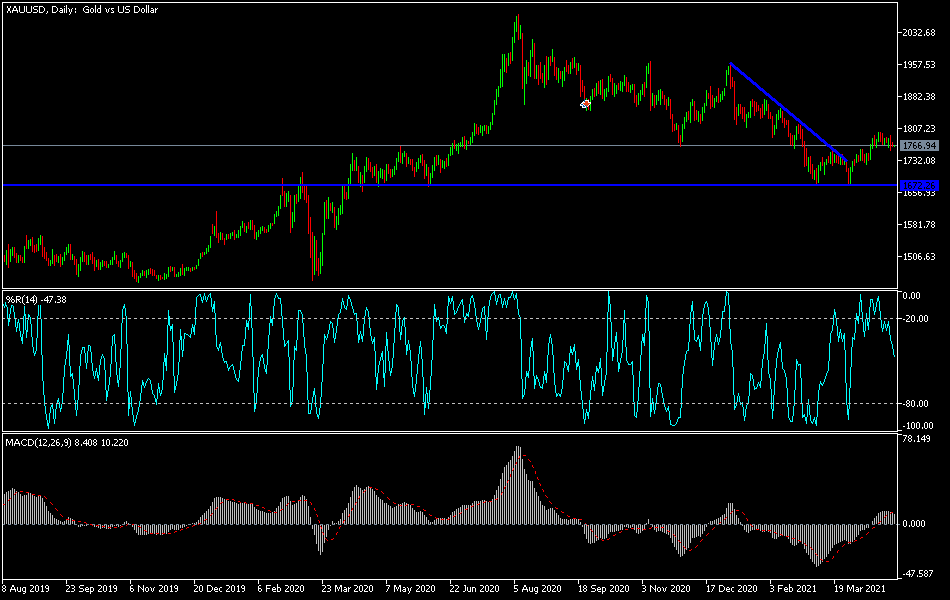

Gold markets fell slightly during the trading session on Friday but remain cognizant of the 50-day EMA sitting just below. The 50-day EMA has offered a certain amount of support over the last week or so, so it should not be a huge surprise to see that we are hanging out just above there. That being said, even if we broke down below the 50-day EMA itself, there is still support underneath that comes into play.

The most obvious support level would be the $1750 level, which had previously been resistance. In that general vicinity I would expect to see a certain amount of buying pressure, but if we were to break down below there then it is likely that we would go looking towards the double bottom which sits just below the $1700 handle. That is an area that I think will continue to be crucial, because if we give that up, the gold market is likely to drop quite drastically. At that point, we could be talking about a move all the way down to the $1500 level.

When you look in the other direction, if we can break above the $1800 level, it is likely that we could go much higher, perhaps reaching towards the $1850 level and then the $1950 level. The biggest problem that gold faces right now is that yields have risen in America, and it might simply be easier to clip coupons in the bond market than try to pay for storage of gold. If rates continue to rise, that will be negative for gold, especially if they rise quite rapidly, as then bonds become much more attractive as they are much safer investment.

I do believe that we need to make a bigger move sooner or later, but right now we just do not have the catalyst to get going. It will be interesting to see how this next week or two play out, as it will be crucial for the next $50 or so. In the meantime, I would let the market form an impulsive candlestick before getting involved, because just like we had seen on Thursday, there is the possibility of a fake out. Wait for a daily close outside of these moving averages to tell you which direction to go.