The share of the British pound against the US dollar was in a rebound up to the 1.4222 resistance level, near its highest level since the start of trading in 2021. It is settling around 1.4185 at the time of writing. Yesterday, the Sterling got some momentum from the better-than-expected UK labor market statistics, confirming our doubts that the Sterling is likely to increasingly respond to the data releases in the short term.

The British Statistical Office reported that 84,000 jobs were created in the three months to March, up from a reading of -73,000 in the three months to February. The result was an expected win for a reading of 50K. "The latest estimates for the period from January to March 2021 show signs of recovery, with a quarterly increase in the employment rate," the National Bureau of Statistics statement said. The number of employees on payroll has now increased for the fifth month in a row but is still below pre-coronavirus pandemic levels by 772,000. Meanwhile, the UK unemployment rate fell for the month of March to 4.8%, which is better than the 4.9% that markets had expected and the 4.9% recorded in February.

In the same regard, policy makers at the Bank of England said that they would like to see the strength of the labor market before they consider raising interest rates, and the market will bet that such a move will not come until sooner if unemployment recovers at a faster rate than the bank’s current expectations imagine.

The general rule is that when expectations are made for a rate hike, the British pound benefits.

The rise in employment was offset by a rise in the average income index (+ bonus) to 4.0% in March, which is lower than the 4.5% the market expected and 4.5% published in February. The Office for National Statistics said that the increase in wages during the virus crisis was largely a result of lower wages for workers who left their jobs: Accordingly, the Office for National Statistics has said since February 2020 that the largest decrease in salary employment in the hospitality sector is among those under the age of 25. Years, and those who live in London.

Thus, a smaller-than-expected rise in wages for March could be related to an increase in employment, indicating a return of these lower-paying jobs. Looking at the vacancies, the Office for National Statistics says the number of vacancies has reached its highest level since January to March 2020.

Most industries were said to have shown increases during the quarter, most notably the accommodation and food service activities. Both the ONS Experimental Vacancy Scale and the Adzuna Pilot Scale showed strong increases in April. However, the main number of job vacancies remains below pre-pandemic levels, with the arts, entertainment, recreation, and accommodation industries being the hardest hit.

Pantheon Macroeconomics expects layoffs to increase again starting in July, when employers must cover 10% of lost wages for any employee who has been furloughed, and then jump in in September, the last month of the program. As a result, they expected the unemployment rate to fall to a low of around 4.5% by June, before rising to around 5.2% in the fourth quarter.

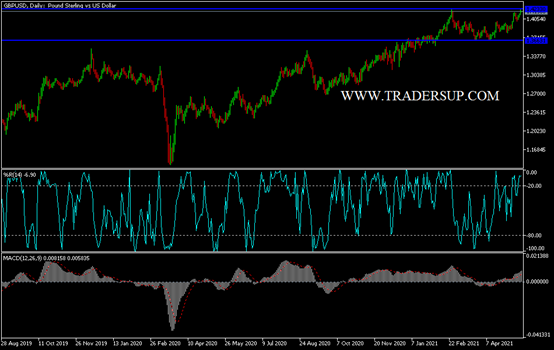

According to the technical analysis of the pair: Bulls will continue to dominate the performance of the stronger GBP / USD currency pair as long as the pair is stable above the 1.4000 psychological resistance. Currently, the currency pair is closest to its highest since 2021, an area that has pushed technical indicators to strong overbought levels. The pair has previously rebounded amid selling to reap profits. Accordingly, I expect selling operations from the resistance levels 1.4245, 1.4320 and 1.4400, respectively. On the downside, according to the performance on the daily timeframe chart, the first reversal of the trend will be by breaching the support level 1.3990.

Today's economic calendar data: Inflation figures in Britain are known by reading the consumer price index, producer price index and retail prices. Then, at a later time, the most important event is the announcement of the contents of the minutes of the last meeting of the US Central Bank.