British pound pairs may face instability during the trading session this week, pending the announcement of the monetary policy decisions of the Bank of England. In the case of the GBP/USD pair, it tried modestly to rebound upwards, but those attempts did not exceed the resistance level 1.3977. By the end of the week's trading, and in light of the dollar's recovery, the currency pair collapsed to the support level of 1.3802 before closing trading around the 1.3812 level. The breach of the 1.38 support will confirm the bears' control of the trend, and thus prepare for stronger support levels until the BoE’s decisions are announced.

In this regard, research from Crédit Agricole shows that the British pound may be subject to political risks in the coming days, and they recommend that the currency be “sold” as a result. A regular weekly research briefing from the France-based bank shows that the British pound is likely to be pulled in opposite directions in the coming days. On the one hand, a “gradual pullback” in the BoE could lead to its rally, but on the other hand, the policy risk premium could pull it in the opposite direction.

There is a growing expectation that policymakers for the Bank of England will slow down the pace of the quantitative easing program in recognition of the rapidly improving economic outlook. Analysts are widely citing the BoE’s slide from a “pessimistic” central bank to a “hawkish” one as the reason for the pound’s appreciation in 2021. If the BoE continues its asset purchase and cuts program, the pound could find some upward momentum.

But for analysts at Crédit Agricole, new political concerns may just triumph. “In the near term, the focus will be on the results of the May 6 elections in Scotland,” said Valentin Marinoff, a currency analyst at Credit Agricole.

Also on May 6, local elections will be held across the UK, so Marinoff says their results will be used to assess the damage to the Conservative Party’s popularity from recent disagreements surrounding the British government and centering on Prime Minister Boris Johnson.

In general, the strong recovery in British economic activity continues to support valuations of the British pound, although the market appears to be waiting for a new and more important catalyst to re-energize investor interest and achieve any real gains. The theme of the UK recovery was underlined by the latest Lloyds Bank Business Barometer, which showed that confidence among UK companies rose above the long-term average for the first time in two-and-a-half years.

Business confidence increased by 14 points to 29% in April, which is above the long-term average (28%) for the first time since September 2018 and its highest level in 2 ½ years. Lloyds also says the rally reflects major improvements in both the trading outlook for next year (up 13 points to 25%) and optimism about the economy (up 15 points to 32%). Less than half of companies (46%) said in the survey that current demand is adversely affected by the epidemic, down from 74% in April 2020. The net balance of employment levels in the next year rose 4 points to 8%, the highest level since February 2020, while a quarter of firms (up from 17% in March) expect to increase average wages of 2% or more.

Given the widespread concerns among economists that the UK will see a jump in unemployment once the holiday scheme expires in September, the data should go a long way in strengthening the outlook. The data align with a consensus view that the British economy should witness a sharp recovery in 2021, and is a major source of support for the British pound.

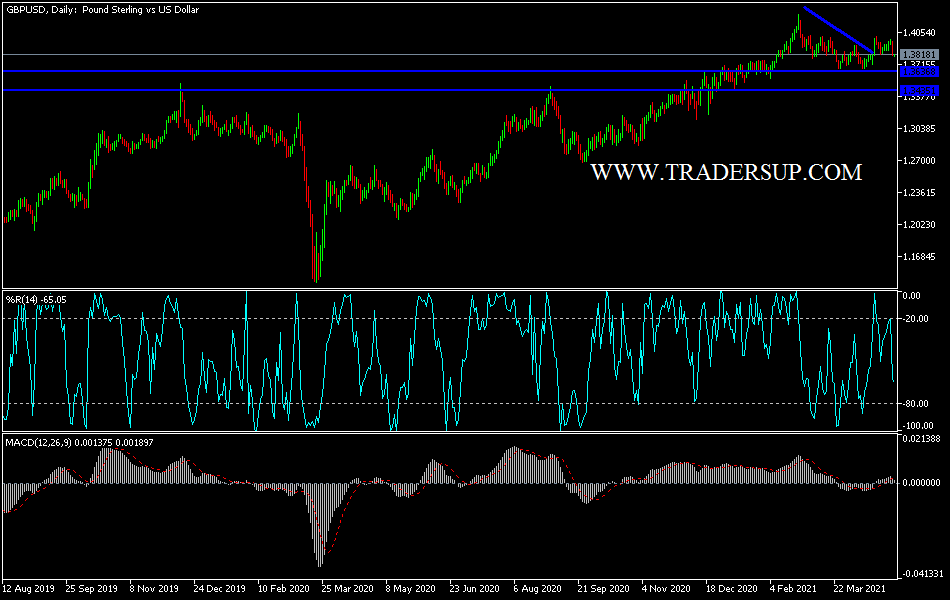

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the GBP/USD currency pair is trading within a rising wedge formation, which indicates significant short-term bullish momentum in market sentiment. The pair has recently retreated to oversold levels on the 14-hour RSI. Accordingly, the bulls will target short-term rebound gains around 1.3897 or higher at 1.3969. On the other hand, the bears will be looking for profits around 1.3746 or lower at 1.3676.

In the long term, according to the performance on the daily chart, it appears that the GBP/USD is trading within the formation of a sharp bullish channel, which indicates strong, long-term bullish momentum in market sentiment. Therefore, the bulls will look to extend the current uptrend towards 1.4103 or higher to 1.4360. On the other hand, the bears will target potential pullbacks around 1.3517 support or below 1.3234 support.

Today, in light of the British holiday, the focus will be on the US economic data, as the ISM Manufacturing PMI reading and the construction spending rate will be announced, followed by new statements by US Federal Reserve Chairman Jerome Powell.