After bullish stability over the last 3 sessions, the GBP/USD has settled around the 1.4165 resistance level, a two-and-a-half-month high. The US dollar got strong momentum from the US inflation figures, and accordingly, the currency pair was subjected to profit-taking that pushed it towards the 1.4050 support level at the beginning of trading on Thursday.

In early trading yesterday, the pound got additional momentum from the announcement that the UK's primary GDP growth rate for the first quarter exceeded the expected change (quarterly) by -1.6%, with a reading of -1.5%. The index (year-on-year) was in line with expectations of -6.1%. On the other hand, March GDP growth beat expectations (monthly) of 1.4% with a change of 2.1%. Industrial production for the month of March also beat expectations (year-on-year) at 3.7% with a rate of 4.8%. On a monthly basis, the index beat expectations for a reading of 1% with the announcement of a reading of 2.1% while industrial production for the month exceeded 1% by 1.8% (monthly). Yesterday's data shows the economy is more resilient to the effects of coronavirus containment measures than many assumed, while indicating room for recovery that may also be stronger than currently expected.

Despite the recent selloff, the pound is still supported by the British progress in vaccinations against the virus. This is in addition to the positive economic expectations of the Bank of England, which confirm that the British economy will now recover to pre-COVID-19 levels in 2021, after it underwent the largest increase in annual growth since 1947, which is a sharp improvement from previous expectations. Accordingly, the Bank of England expects GDP growth in 2021 of 7.25%, which is a material increase from the 5.0% expected in February, as economists at the bank say the improvement is due to progress in vaccinations and government financial support.

The Bank of England now believes that the country's unemployment rate will peak at 5.4% in the third quarter of 2021, instead of the 7.8% previously expected. Given the much-improved expectations of the Bank of England for the British economy, a number of Forex analysts expect that the GBPUSD pair is ready to move strongly higher in the coming period.

Analysts saw that the local and regional elections that took place last week gave investors reason to hold back on buying the pound, especially given concerns that the strong performance of the Scottish National Party (SNP) could lead to a constitutional confrontation between the Scots and Westminster on holding a second independence referendum.

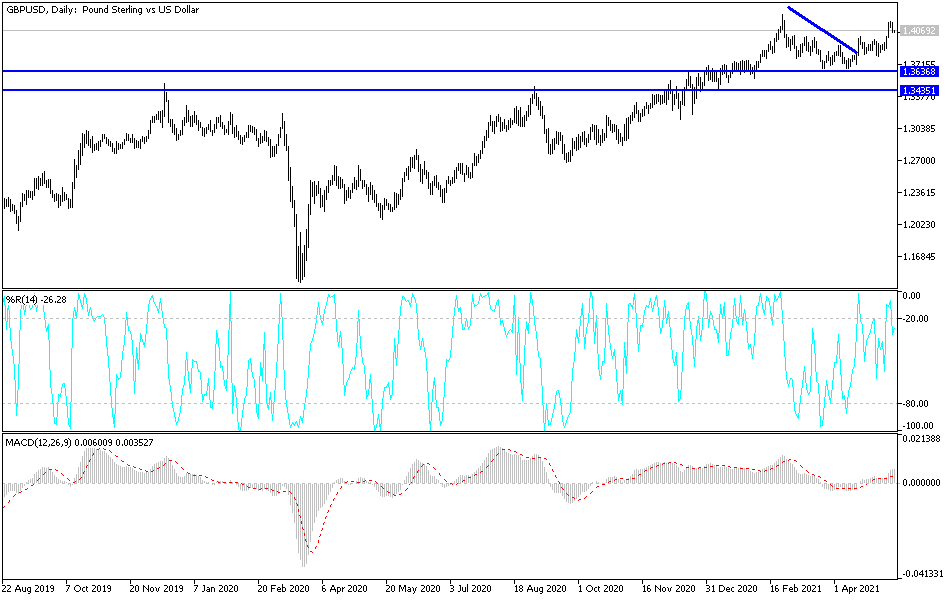

Technical analysis of the pair:

In the short term, according to the performance on the hourly chart, it appears that the GBP/USD currency pair has declined recently after a sharp rise. The pair encountered strong resistance around the 1.4150 level, which led to a pullback on Wednesday. Accordingly, the bulls will target the short-term retracement gains around 1.4125 or higher at 1.4150. On the other hand, the bears will be looking to extend the current decline towards support 1.4079 or lower at 1.4053.

In the long term, according to the performance on the daily chart, the GBP/USD currency pair appears to be facing strong resistance around 1.4170 after a sharp rally. The pair continues to trade several levels above the 100- and 200-day simple moving average lines. It has also risen near overbought levels in the 14-day RSI. Therefore, the bulls will look to breach the current resistance level by targeting profits around 1.4170 or higher at 1.4246. On the other hand, the bears will target potential pullbacks around 1.4023 or lower at 1.3946.