I had predicted in recent analyses that the GBP/USD pair's stability in a limited range for several trading sessions in a row would herald an imminent price explosion in one of two directions. The GBP/USD has now exploded to the upside, supported by disappointing numbers for US jobs. The price of the currency pair jumped to the 1.4158 resistance level, a near-3-month high, and settled around 1.4120 at the beginning of trading on Tuesday, ahead of highly anticipated comments from the governor of the Bank of England. As it is known, the weaker US jobs numbers were an important factor in the recent gains in the currency pair.

The British pound rose in early trading this week against the rest of the other major currencies. Some of the political risks affecting the currency have been eliminated, and here analysts offer their views on the recent action in the currency and what the future holds regarding the vote on Scottish independence. As such, markets took a more constructive approach to the pair after weekend news that the Scottish National Party (SNP) won 64 seats in the Scottish Parliament elections, leaving it one seat below the overall majority.

However, the Greens would support the Scottish National Party to form a coalition seeking to hold another referendum on Scottish independence at some point in the future.

“The British pound is in a good mood at the start of the new week after the Scottish National Party narrowly failed to secure an absolute majority in the local Parliament elections,” says Hadjikirios, an investment analyst at XM.com. Accordingly, the pound's reaction indicates that with the inability of the Scottish National Party to secure that absolute majority, there is no clear democratic mandate to pressure London to grant another referendum anytime soon. Jane Foley, Forex Analyst at Rabobank says: “The results of the local elections in England and the parliamentary elections in Wales and Scotland have provided the British pound with some support in the market. But at the same time, she warns that "the issue of Scottish independence could continue to undermine the gains of the pound in the next 12 to 18 months."

Elias Haddad, chief currency analyst at the Commonwealth Bank of Australia (CBA), says that in the long run, the prospect of a constitutional confrontation between Westminster and Holyrood means that the British pound will continue to trade at a discount from its primary balance. He added that the UK may struggle to attract long-term investment flows to finance the UK's widening current account deficit as a result. Haddad added, "The balance based on real yield spreads indicates that the GBP/USD is approaching 1.5500 and the EUR/GBP is near 0.7000."

In general, the underlying economic picture in the UK remains resolutely constructive, which could provide a rally in the value of the pound over a period of several months, according to analysts. Thus, Gaétan Peroux, a strategic analyst at UBS, says: “We still prefer pro-cyclical currencies, including those under discussion at this week’s central bank meetings (i.e., the Australian dollar, the British pound and the Norwegian krone) against the yen and the dollar."

The pound sterling is also affected, either positively or negatively, by the global economic performance. As the global economy continues to recover from COVID-19, it is supported by huge incentives coming from the United States and China. Hence, the UK economy is unlikely to miss this boom. The United Kingdom suffered the deepest falls as the COVID-19 crisis imposed strict lockdowns, but it is likely to see one of the most severe recoveries according to economists. The Bank of England (BoE) also maintains this assumption and said in its policy update on Thursday 06 May that they are raising their 2021 GDP forecast for 2021.

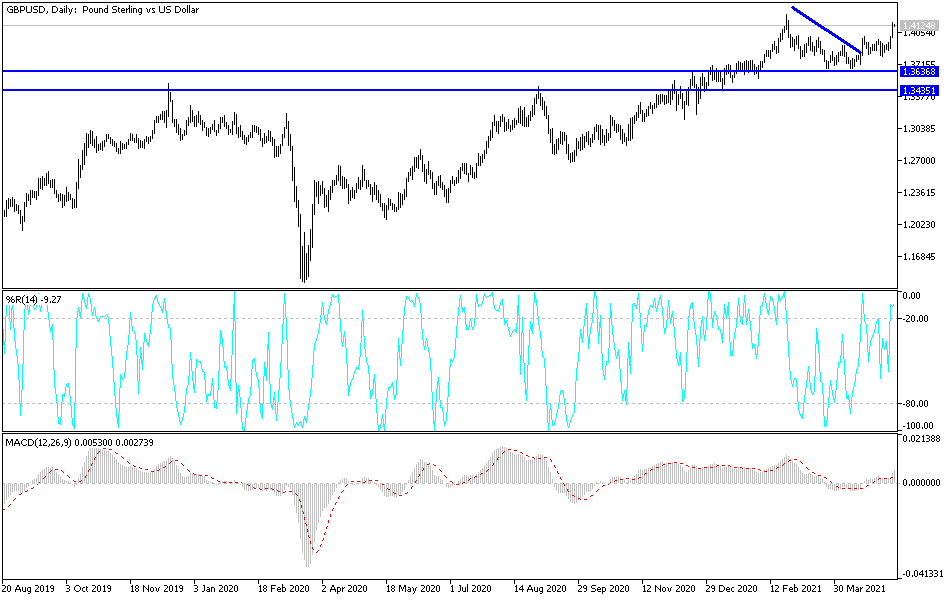

Technical analysis of the pair:

The breach of the 1.4000 psychological resistance is an important event for the bullish trend of the GBP/USD, and the bulls' performance amid more buying operations was distinguished. The consecutive gains are pushing the technical indicators to near strong overbought levels. If the pound does not get more momentum, profit-taking may be triggered at any time. The nearest resistance levels currently for the pair are 1.4185, 1.4245 and 1.4400. In contrast, according to the performance on the daily chart, the bears will regain control over the performance by moving towards the support level 1.3945. Otherwise, the general trend will remain bullish.

Today's currency pair will be affected by investor risk appetite for risk or not, as well as the reaction from the Bank of England governor's comments.