In an attempt to recover ahead of important events, the GBP/USD pair is moving around 1.3915 since the start of trading on Tuesday, before testing the 1.3860 support level as of this writing. The recent selling amid the dollar's recovery pushed the currency pair to the 1.3797 support level. The exchange rate of the pound against the dollar entered the new week down sharply from its highest levels in April after the mood of investors in global financial markets soured on Friday, but it is likely to continue its recovery if the pound gains momentum from the Bank of England this week. The GBP/USD pair suffered its biggest daily loss since late February at the end of last week after it seemed that the high yields of US bonds were pulling the rug from under many currencies, despite the measures of the end of the month for investors and the last day of trading in Japan and China before. Looking ahead to a series of public holidays also plays a role in the performance of the currency pair.

US yields were in a renewed decline with the closing of trading at the end of the week, and if this remains the case in the coming days, it is likely that the price of the GBP/USD will find its lost position above the 1.38 level, although it may need a clear stimulus from the Bank of England (BoE) before it could gain a meaningful recovery momentum. Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says: “The near-term declines in the GBP/USD are expected to be strong and the bullish bias above the uptrend is maintained at 1.3714. A close above 1.4018 may target 1.4238 / 45."

The Bank of England event next Thursday is the most prominent event of this week for the pound, but before then, global market conditions, especially price movement in the US bond market, will determine the mood of investors and the direction of dollar exchange rates.

The dollar gained on Friday after a wave of strong US economic data and after FOMC member Robert Kaplan repeated an already well-known but also “very hawk” assessment of the US economy and a recipe for Fed policy. "Meester could repeat Kaplan's call for a conversation about tapers," says Richard Franolovich, a Westpac analyst. "The core of the pessimistic Fed will have none of that, but it is likely that better US data and more regional Fed optimism put the dollar index in a position to bounce in the short term this week.”

Kaplan, who is also the chairman of the Federal Reserve Bank of Dallas, has called for the imminent end of the Fed's $120 billion per month quantitative easing program and an increase in interest rates this summer, although he will not be a voting member of the FOMC again until 2023. This was just days after the Fed convinced investors and markets that there is little chance that the bank will tend to discuss changes in its current monetary policy settings before the end of the year, which affected the dollar and lifted the GBP/USD pair above 1.39 for the first time in April.

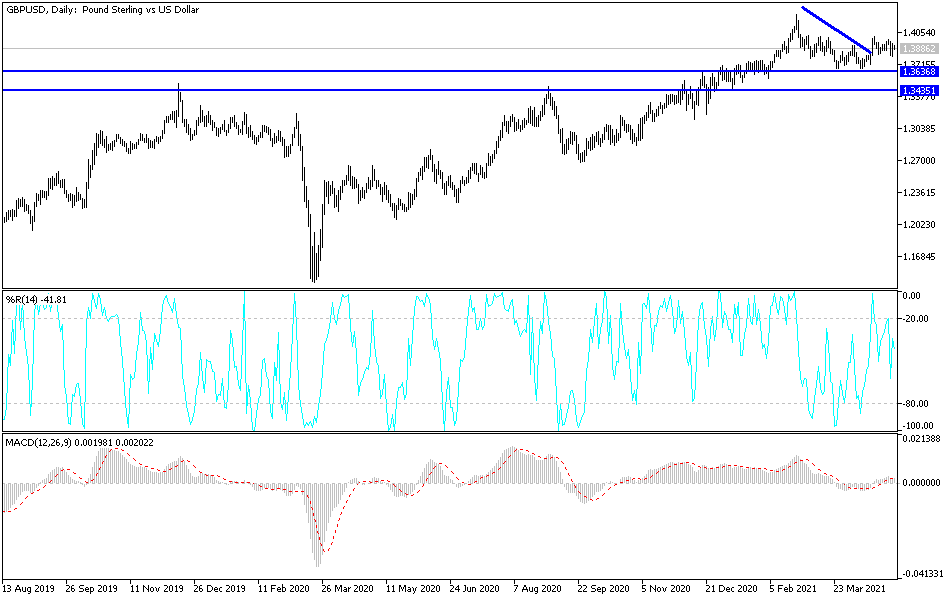

Technical analysis of the pair:

On the daily chart, the GBP/USD is in a neutral position and may tend to rise more if it stabilizes above the resistance 1.3920, which paves the way for a breach of the 1.4000 psychological resistance, which is crucial for a bullish performance. Factors for the currency pair's gains are still intact, so any dips may be an opportunity to consider buying. I see that the most important support levels currently for the currency pair are 1.3785, 1.3690 and 1.3600.

The currency pair will be affected today by the announcement of the British Industrial Purchasing Managers' Index reading, along with net lending to individuals and mortgage approvals. Then, the figures for the trade balance and factory orders in the United States of America will be announced.