The GBP/USD pair moved towards the 1.4025 resistance level at the beginning this week's session, the highest for the pair in two-and-a-half months. The pair's gains were supported by the negative impact of the US dollar from the US jobs results for the month of April, which negatively affected the recent state of optimism about the improvement in the performance of the US economy amid continued vaccination efforts and stimulus plans, with the latter being blamed for the poor employment figures, given that many Americans are incentivized not to work now due to the Biden administration's irresponsible fiscal policies.

The US dollar fell sharply against other major currencies after data showed that US jobs grew less than expected. The much anticipated non-farm payrolls figure for April came in at 266K, which is well below the 978K jobs expected by the US economy.

The surprising weak figure will cast doubt on the economic recovery of the US and confirm that the US economic strength is currently translating into the strength of the US dollar. The US unemployment rate rose for the month of April to 6.1% from 6.0% in March, and markets had been expecting a decline in the unemployment rate to 5.8%. Commenting on the results, Kathryn Judge, an economist at CIBC Capital Markets, said the resilience was relatively broad, with the commodity sectors seeing losses during the month, while the entertainment and hospitality sector was the only services sector that saw material job gains, with the government being the second best performance.

For its part, the US Federal Reserve said in March that it will keep interest rates unchanged and that quantitative easing will continue until it is convinced that the job market is on its way to a sustainable recovery. The bank’s policy was in need of a series of massive positive US jobs reports as a prerequisite for the market to start pricing at higher interest rates in the US.

The United States asked the federal government this week to withhold massive quantities of the COVID-19 vaccine amid declining demand for syringes, contributing to an increase in the US stockpile of doses. From South Carolina to Washington, states are asking the Biden administration to send only a fraction of what has been allocated. The rejected vaccines are reaching hundreds of thousands of doses this week alone, providing a stark illustration of the problem of vaccination frequency in the United States.

More than 150 million Americans - about 57% of the adult population - have received at least one dose of the vaccine, but government leaders are doing their best to convince the rest of the country to get vaccinated. The Biden administration announced this week that if states do not order all of the vaccines that have been allocated to them, the administration will divert the surplus to meet demand in other states.

Scotland's leader told British Prime Minister Boris Johnson on Sunday that the second referendum on Scottish independence is "only a matter of time" after her party won the fourth consecutive parliamentary election. For his part, Johnson called on the leaders of the UK-delegated countries to hold crisis talks about the union after the results of the regional elections, saying that the UK is “served better when we work together” and that the delegated governments in Scotland, Wales and Northern Ireland must cooperate in plans to recover from the pandemic.

But Nicola Sturgeon, Scotland's first female minister and leader of the Scottish National Party, told Johnson in a phone call that while her immediate focus was on steering Scotland toward recovery, a new referendum on Scotland's secession from the rest of the United Kingdom was inevitable.

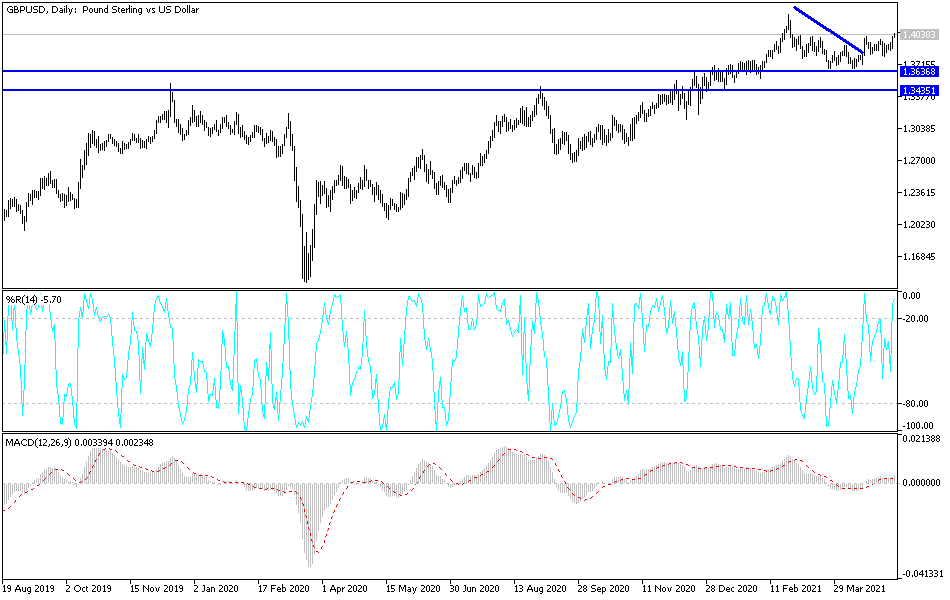

Technical analysis of the pair:

A break through the 1.4000 level will stimulate the general bullish trend of the GBP/USD and, according to the performance on the daily chart, there are some indicators that began to give overbought signals. The best selling levels are the resistance levels at 1.4085, 1.4155 and 1.4290. The sterling’s gains against other major currencies may face instability in the coming period.

On the downside, the bears will shift control over the performance, moving towards the support levels at 1.3920, 1.3855 and 1.3780. The currency pair does not expect any important data either from the United States or Britain today.