Geopolitical tensions subsided and the dollar weakened after US employment report. This contributed to a sharp bullish rebound in the GBP / USD currency pair, to the 1.4146 resistance level, the highest in the currency pair two and a half months ago. It settled around 1.4138 at the beginning of trading on Wednesday, amid cautious anticipation of the announcement of the British economic growth numbers and the US inflation reading.

This may cause a strong reaction to the performance of the currency pair.

All in all, investors have now largely ignored the political considerations, thus focusing more and completely on the apparently bullish outlook for the Bank of England for the British economy and buying the British pound. Many forex analysts noted that the GBP's gains at the start of the week were in fact a late reaction to the event the previous Thursday of the Bank of England (BoE). Commenting on this, Chris Turner, an analyst at ING Bank, said: “We read this step as a more legacy as the market heads towards the set of bullish expectations for the Bank of England in the UK.

The Bank of England's economic forecasts show that the British economy will now recover to pre-Covid 19 levels in 2021, after having experienced the largest increase in annual growth since 1947, a sharp improvement from previous expectations. Accordingly, the Bank of England expects the country's GDP to grow in 2021 by 7.25%, a material increase from the 5.0% expected in February, as economists at the bank say the improvement is due to progress in vaccinations and government financial support.

The Bank of England now believes that the country's unemployment rate will peak at 5.4% in the third quarter of 2021, instead of the 7.8% previously expected. Given the much-improved expectations of the Bank of England for the British economy, ING now expects that the GBP / USD pair will split towards the 1.4200 and 1.4250 resistance levels, respectively.

Meanwhile, forex analysts saw that last week's local and regional elections gave investors reason to hold back on buying the pound sterling, especially given concerns that the strong performance of the SNP could lead to a constitutional confrontation between the Scots. Administration and Westminster on holding a second independence referendum. So the narrative heading into Thursday's vote was that the SNP majority would in fact provide a strong mandate for another vote.

But given the Scottish National Party’s failure to reach a majority, analysts say the road to another referendum is certainly more difficult and may only happen over a number of years. “The pro-independence parties will need to quickly resolve the differences that prompted them to campaign separately in the first place,” says Fabrice Montany, an economist at Barclays Bank. The complexity of Scottish independence means that members of such a pro-independence coalition will almost certainly disagree with regard to practical implementation, which could weaken the cause for independence ”.

The Scottish National Party will form a government with the help of the Green Party, whose eight seats will allow the coalition to govern effectively. Meanwhile, Scottish National Party leader Nicola Sturgeon said she would only direct her government toward a referendum once the COVID-19 pandemic was dealt with.

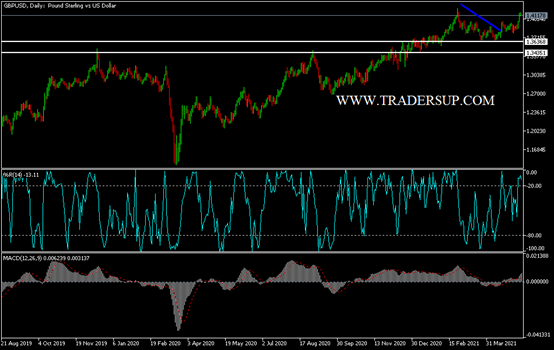

According to the technical analysis of the pair: The general trend of the GBP / USD pair is still up, and there will be no shift in the direction to the downside without breaching the 1.4000 support. Despite the recent gains and according to the performance on the daily timeframe chart, the currency pair still has the opportunity to achieve gains before those indicators reach strong buying saturation levels.

The closest resistance levels currently for the pair are 1.4195, 1.4255 and 1.4340, respectively. After the confidence of the Bank of England, and in the event that the British economy continues to improve and after the storm of political anxiety passes, I prefer buying the currency pair from every downward level.

As for the data of the economic calendar today: From Britain, the rate of growth of the British economy will be announced, along with the figures of the trade balance of goods, the rate of industrial production, the rate of investment in business and the rate of industrial production. From the United States, the most important reading of the US consumer price index and the comments of some US central bank policy officials will be announced.