The GBP/USD continued its attempt to make up for recent losses by moving to the 1.3915 resistance level before settling around 1.3885 at the beginning of trading on Wednesday. The currency pair may stick to this performance until the Bank of England monetary policy decisions are announced on Thursday. The Bank of England is widely expected to leave the bank interest rate unchanged at 0.10% and the £895bn target for its quantitative easing program unchanged, although investors will pay special attention to the bank's inflation outlook.

All in all, any suggestion that the 2% target can be sustainably achieved sooner than anticipated is likely to be taken as an indication that interest rates may also rise sooner, which will be supportive of the British pound. Commenting on the performance of the currency pair, Juan Manuel Herrera of Scotiabank says in a note: “The British pound remains in a modest bullish trend with three consecutive weekly gains and all eyes are watching for a test of the 1.40 psychological summit in the coming days if the current path continues.”

Vaccinations in the UK are expected to accelerate during the month of May, allowing the UK's economic recovery to proceed as planned. The news comes on the heels of the pound's weak performance in April, and those who want a stronger UK currency hope it can rediscover its vaccine-backed rally in May.

According to press reports, the vaccine rollout should speed up in May amid strong supplies and an easing of vials allocation requirements for second doses.

It must be emphasized from the outset that there are a number of factors that the British pound will have to face in the coming days and weeks: 1) the policy decision of the Bank of England 2) the Scottish elections 3) global risk sentiment and 4) the recovery of the domestic economy.

Some analysts believe that fears of a slowdown in the rollout of vaccinations in April may be a factor contributing to the pound's relative weak performance last month. But signs that the program is in fact on the right track to overcome current targets should at least put this concern at the bottom of investor concerns. “The rapid spread of vaccines and the associated continuous decline in restrictions means that there is a strong recovery in activity from the second quarter onwards,” says Niksch Sujani, an economist at Lloyds Bank.

The average first dose in the UK is around 110,000 vaccines per day, a sharp drop from the 300,000 levels seen in March. However, health officials there told the NHS on Friday that people aged 40 and over in England can now book their COVIID vaccines. About 34 million people have taken at least one dose in the UK.

This equates to nearly two-thirds of the adult population, while more than 14 million people have now taken the two doses.

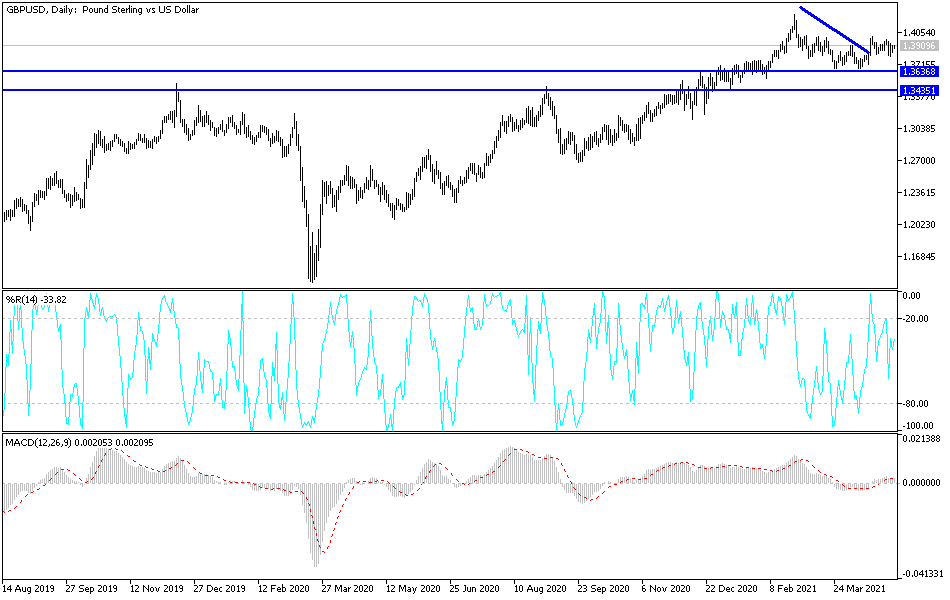

Technical analysis of the pair:

The GBP/USD is displaying a neutral performance on the daily chart. The bullish trend will be stronger if the pair breaks through the psychological resistance level of 1.4000, which may increase buying and push the currency pair towards higher resistance levels, the closest of which are 1.3985, 1.4055 and 1.4165. In return, the currency pair will return on a downward path if it moves below the support level of 1.3745, and I still prefer to buy the currency pair from every downward level.

The pair is not anticipating any important UK economic data. The focus will be on the US session data, where the first release of US jobs numbers will be announced, as well as the ADP survey to measure the change in non-farm payrolls and the ISM Services PMI reading.