The GBP/USD pair achieved strong gains that pushed it during last week’s trading to the 1.4220 resistance level, nearly its highest since the beginning of 2021. The bears' gains from profit taking did not exceed the support level of 1.4090 before closing trading stable around the 1.4188 level. This week's trading started stable around the 1.4190 level, and with today being an American and British holiday, it confirms the possibility of the currency pair moving today in a narrow trading range.

All in all, comments by BoE Monetary Policy Committee Member Vlieghe helped lift the pound back above $1.42 after briefly dropping below $1.4100 for the first time in ten days. The official spoke indirectly about the currency by talking directly about interest rates. It seems Vlieghe took for granted that a rate hike was likely to take place in the second half of next year.

However, he did point to the possibility of an earlier spike linked to labor market performance after the expiration of the vacation scheme program that backed the wages of those impacted by COVID and may mask a larger rise in unemployment. Vlieghe is seen as a mediator, and his term expires on August 31. The yield on the 10-year bond increased by six basis points, while the yield on the two-year Treasury note increased by four basis points from one point.

On the other hand, British Health Secretary Hancock indicated that the final stage in the economic reopening may not actually materialize on June 21 as planned. This is due to the official assessment of the data pertaining to the mutation first identified in India that is increasing cases in the UK. The number of infections in the UK has risen in recent days, and hospitalization is also on the rise.

Business confidence in the UK is at a three-year high, while economic confidence is at its highest in five years, according to the latest release of Lloyds Bank Business Barometer. Business confidence increased for the fourth consecutive month, by 4 points to 33% in May, the highest level in three years.

Optimism about the British economy rose 5 points to 37%, the highest level since 2016, while prospects for corporate trading rose 3 points to 28%. The improvements follow the third phase of the opening on May 17 that saw most of the UK's remaining businesses open, buoyed by the country's vaccination program.

The assessment of trading prospects for next year increased 3 points to 28%, the highest level since late 2018, with 42% (up from 39%) expecting stronger trading activity and 14% (unchanged) expecting weaker production. The survey also revealed that the country's labor market continues to improve with employment expectations increasing 6 points to 14%, with a third of companies expecting an increase in their workforce.

The results come a day after the Office for National Statistics said that online advertising metrics had reached pre-pandemic levels and come a week after the flash PMIs for May showed an increase in hiring intentions at British firms.

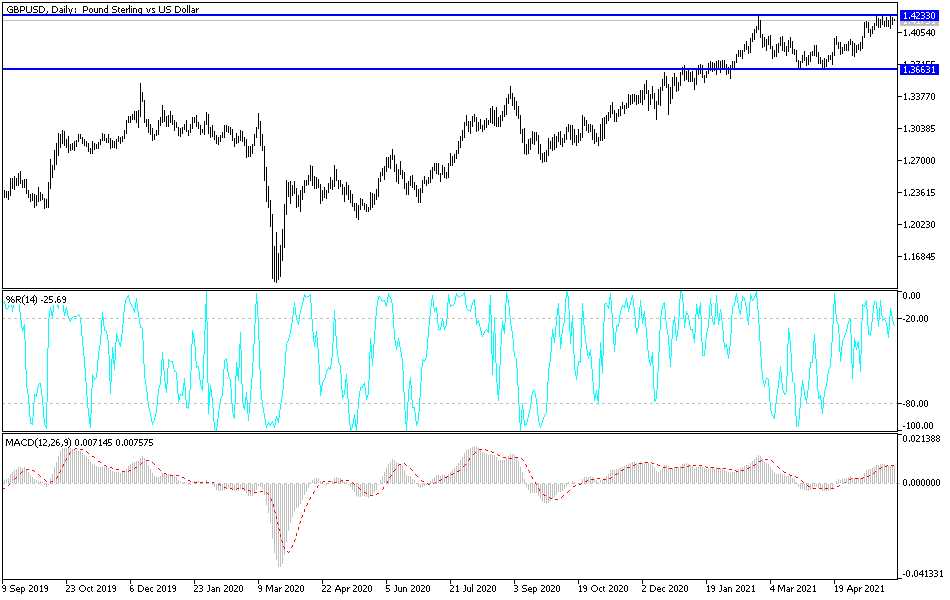

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the GBP/USD is trading within the formation of a highly volatile neutral channel. The pair recently bounced back to avoid slipping into oversold levels on the 14-hour RSI. Accordingly, the bulls will look to push this rebound higher towards the 1.4221 resistance or even higher to the 1.4278 resistance. On the other hand, bears will be looking for gains that fall around 1.4151 support or lower at 1.4107 support.

In the long term, based on the performance on the daily chart, it appears that the GBP/USD is trading within an upward channel formation. It continues to trade near the overbought levels of the 14-day RSI. This indicates a significant long-term bullish momentum in market sentiment. Accordingly, the bulls will look to extend the current uptrend towards the 1.4505 resistance or above to the 1.4753 resistance. On the other hand, the bears will look to pounce on a potential pullback at 1.3926 support or lower at 1.3664 support.

Amid the US and UK holidays, investor risk appetite will be the main driver for the currency pair today.