Bearish View

- Sell the GBP/USD ahead of BOE’s decision.

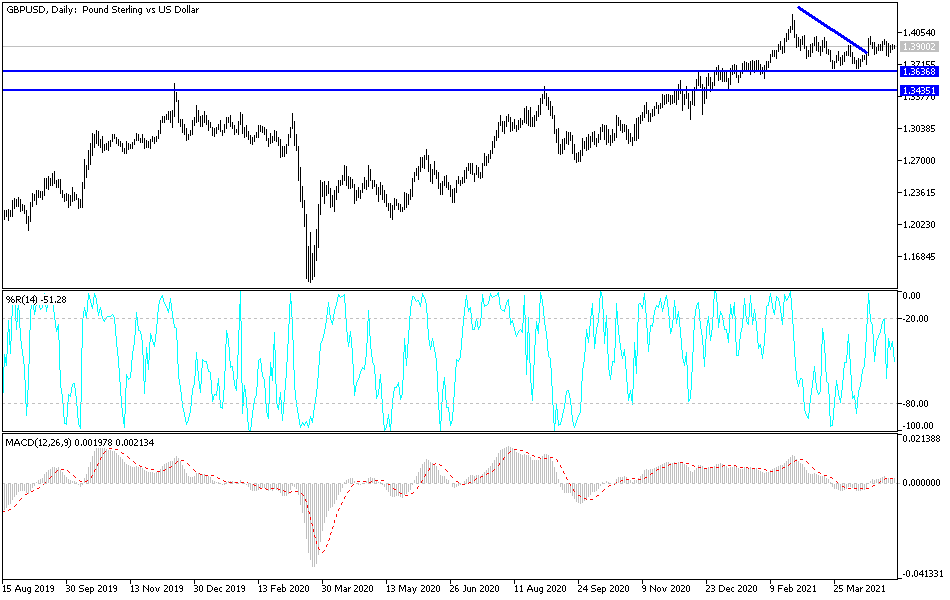

- Set a take-profit at 1.3800 and stop-loss at 1.3950.

- Timeline: 1 day.

Bullish View

- Set a buy-stop at 1.3930 and a take profit at 1.400.

- Add a stop-loss at 1.3880.

The GBP/USD is in a tight range as traders wait for the Bank of England (BoE) to deliver its interest rate decision. It is trading at 1.3905, which is slightly below this week’s high of 1.3925.

Bank of England is the Catalyst

Like most developed countries, the UK economy is rebounding at a faster pace than initially expected. This growth has been helped by the rising investments by companies now that the UK and the European Union made a Brexit deal.

Further, the UK government has intensified its vaccination efforts. It has vaccinated more than 35 million people and is on track to intensify the vaccination process. As a result, the number of new cases and deaths has been on a downward trend.

It is against this backdrop that the BoE will conclude its latest decision. Based on its previous guidance, the BOE will likely not hike interest rates because it wants the economic growth to last.

At the same time, the bank is expected to maintain its quantitative easing target to 150 billion pounds this year. There is also a possibility that the bank will start talking about tapering of the purchases. Like most central banks, there is a possibility that the BoE will upgrade its outlook of the UK economy.

The GBP/USD will also react to the latest US initial jobless claims numbers that will come out in the afternoon session. The data is expected to show that the number of new claims continued to decline last week as the labor market tightens. The continuing claims are also expected to drop. These numbers will come out a day before the latest non-farm payroll data. Analysts expect the economy created more than 800,000 jobs in April as more states continued to reopen.

GBP/USD Analysis

The GBP/USD is trading at 1.3905. On the three-hour chart, the price consolidates at the 25-day and 15-day exponential moving averages (EMA). It has also formed a wide descending channel. It also seems to have formed a double-top pattern that is shown in black. Its neckline is at 1.3840 while the two lines of the stochastic oscillator are close to the overbought level.

Therefore, the pair may continue falling as bears target the support at 1.3840 since double-top is a bearish sign. This prediction will be invalidated if the price moves above the upper side of the channel.