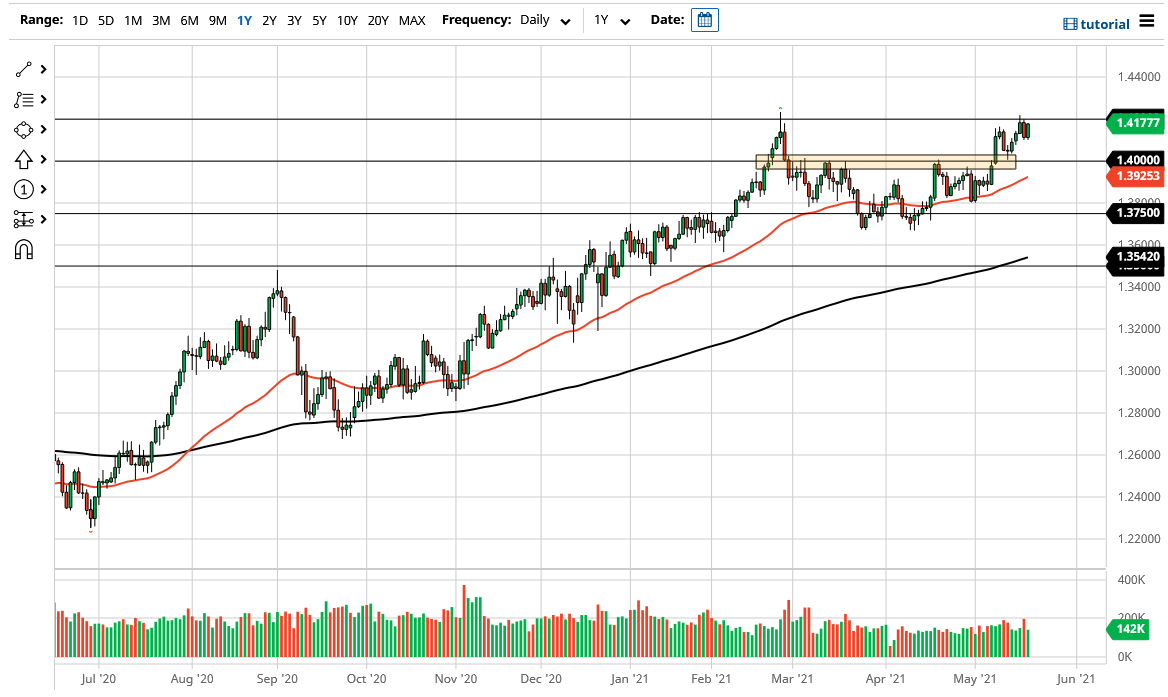

The British pound has recovered nicely during the trading session on Thursday to reach towards the 1.4180 level, which of course is just below the 1.42 handle. The 1.42 level has been important in the past, as it is where we formed a major topic before pulling back of the last couple of months to form a certain amount of a basing pattern that people will be paying close attention to. We had fallen all the way down to the 1.37 level before turning around towards the 1.42 handle again.

When we broke above the 1.40 level several days ago, we pulled back to retest it, only to show signs of strength again and now I believe that the 1.40 level is going to be a short-term “floor” in the market. Ultimately, this is a market that I think will continue to see buyers on dips, and I do think that we are trying to build up enough momentum to break out to the upside and make a much bigger move.

If we can break above the 1.42 handle, then it is a market that could go looking towards the 1.45 handle. The 1.45 handle has been a large, round, psychologically important barrier in both directions historically, and I think that would continue to be the case going forward. That being the situation, I like the idea of finding value on these dips and I do think that it is only a matter of time before we break out to the upside as it would be very similar to a beach ball being held under water. Once we break the surface, we should skyrocket right away as it has been so resistive.

As far as selling is concerned, I have no interest whatsoever in trying to do so anytime soon, as this is a market that has been strong for several months, with the exception of the last couple where we had been working some of the excess froth off from that massive move to the upside. Ultimately, this is a market that I think can only be traded in one direction, so I am either going to wait for the short-term pullback, or a daily close above that 1.42 level to start going long. All things been equal, the US dollar continues to suffer, and I think that will show up here as well.