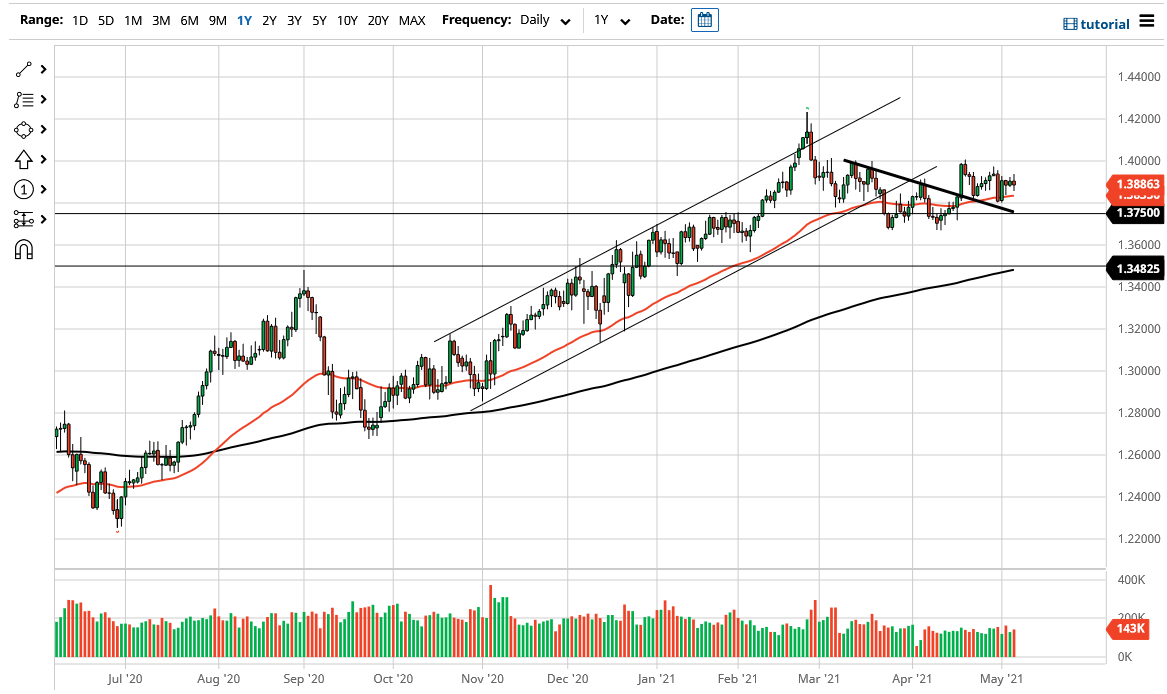

The British pound has gone back and forth during the course of the trading session on Thursday as the Monetary Policy Committee out of the United Kingdom has come and gone, with the announcement suggesting that tapering is going to be much quicker than initially thought. This obviously drove the British pound higher, but by the end of the day we have seen this market go back and forth, showing signs of uncertainty. With that being the case, the market is sitting on top of a crucial indicator in the form of the 50 day EMA indicator. Ultimately, we also have the previous downtrend line that should offer support, right along with the 1.3750 level. After that, we even have a double bottom that has been crucial previously.

It is not until we break down below that double bottom that I would become concerned, because there is so much support underneath it would have to be worked through in order to break down. If that were to happen, it would be a very negative sign for the British pound and could open up a move down to the 1.35 handle. The 1.35 handle also features the 200 day EMA which I will consider to be the end of the overall trend if we get below there.

To the upside, the 1.40 level continues to be important resistance, as we have seen the market try to get through it multiple times and fail. That being said, the market breaking above there could open up the possibility of a move towards 1.42 handle, but with the jobs number coming out on Friday, it is very likely that we will continue to see a lot of volatility over the next 24 hours. At this point in time, I am not a huge fan of putting money to work until we get that announcement and reaction out of the way, but it is obvious to me that we will see a lot of choppiness in the short term and therefore think it is only a matter of time before we have to make a bigger decision, and all things being equal it is very likely that we will continue the upward trajectory but that does not mean that it will be easy. All things being equal, it is likely that we will get continuation eventually, but we are still sideways in the short term.