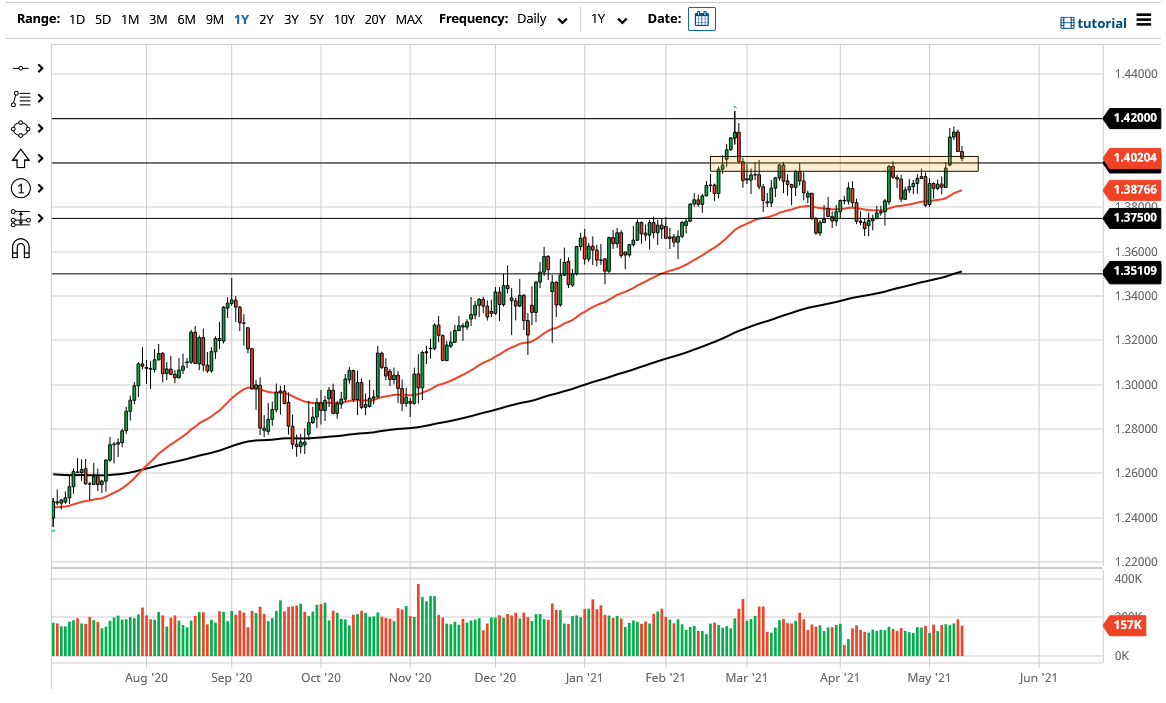

The British pound has fallen again during the trading session on Thursday, to reach down towards the 1.40 handle. The 1.40 handle is an area that a lot of traders will pay close attention to as it was a major resistance barrier that has recently been broken. We have not come back to completely retest it yet, and I think that is what we are in the midst of doing. Because of this, I think that the Friday session will probably see an attempt to find buyers at the 1.40 handle, and therefore by the end of the day we could get a signal to start going long.

With that being the case, we could very well find this market bouncing around between the 1.40 and the 1.42 level. I think you will probably see a lot of range bound traders come back into play, as this could be the ideal set up.

Having said that, if we were to break down below the 1.30 950 level, then we may get a little bit more of a pullback, but we also have the 50 day EMA sitting right in that area just below, and then of course the 1.3750 level would be an area that you have to look closely at as well. At that point, I think you would see a lot of support, and even though some people are talking about a potential “double top” at this juncture it is just that: a potential double top. In other words, you cannot trade it as such, and therefore you have to assume that the longer-term trend continues.

What I have seen is a volatile consolidation area that recently has been broken out of, and now recognizes the 1.42 level as an area that is going to be difficult to get above. Difficult does not mean impossible, and that is exactly how I am looking at this market. Given enough time, I fully expect this market to break higher and go looking towards the 1.45 handle. This does not mean that we get there quickly, but certainly I think that selling this market is all but impossible at this point. Ultimately, I remain a “buy on the dip” type of trader in this market and will be watching the daily close with great interest.