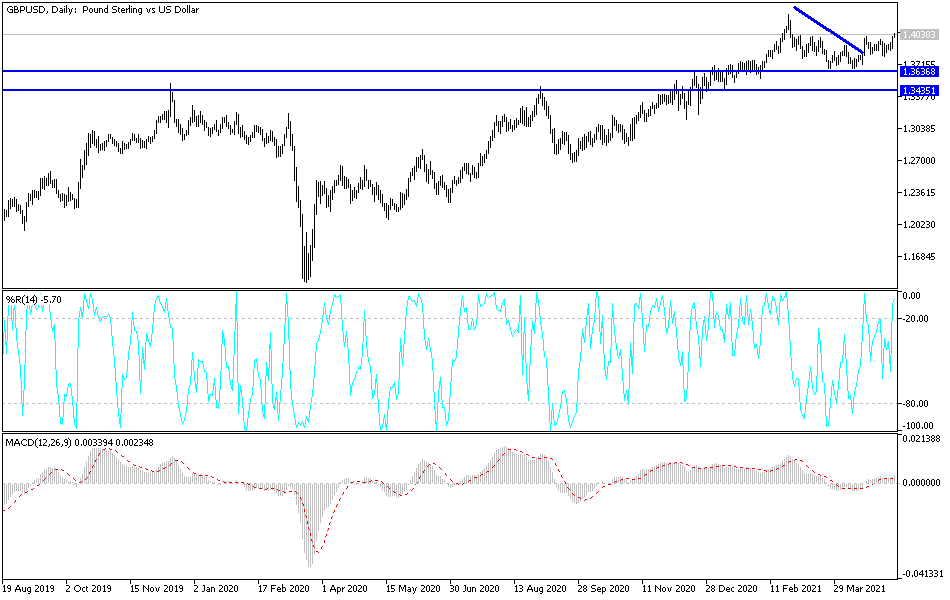

The British pound rallied significantly during the trading session on Friday after the jobs number in America was a huge disappointment. The market needs to have the momentum to stay above the 1.40 handle, something that it has not been able to do as of late. However, if we get above this area, then it would fulfilled the “rounding bottom” formation that we have been trying to build, or perhaps even something akin to a “complex inverse head and shoulders.”

Regardless, this is a market that is going to continue to see a lot of bullish pressure, and I think it is only a matter of time before we do see the breakout. As far as money is concerned, it is very likely that we could get a short-term pullback, but after this type of candlestick I do believe that eventually the buyers will come in to try to pick up bits and pieces of value. After all, the Bank of England on Thursday stated that they were going to slow down their bond buying program, which is akin to tightening monetary policy. That should lift the British pound given enough time.

Furthermore, we had been in a massive uptrend line for quite a while, so it should not be a huge surprise that we have seen the market recover. The 50-day EMA underneath should offer a bit of a short-term floor, and most certainly the double bottom will as well. To the upside, I believe that we will go looking towards the 1.42 handle above, which has been a major resistance barrier. Ultimately, I do think that we will get there; but whether or not we can break through there is a completely different question altogether. If we can, this market will go much higher and perhaps go looking towards the 1.50 level over the longer term. Obviously, we would probably have a stop at the 1.45 handle that we need to do, working off some of the move. The size of this candlestick is bullish, so that is one thing that you need to pay close attention to as well. The confidence on the close normally means that people are willing to try to chase the momentum of the market overall. At this point, I have very little interest in trying to short this market.