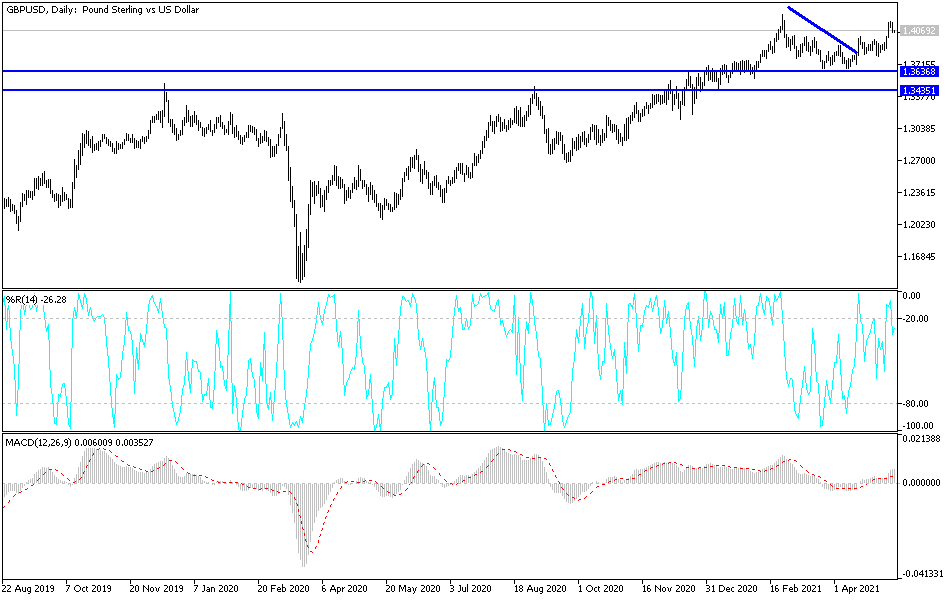

The British pound sold off drastically against the US dollar during the trading session on Wednesday as the US CPI numbers came out much hotter than anticipated. This being said, we saw the greenback strength come back to the forefront, but longer term, it is only a matter of time before we see buyers again. I suspect that the 1.40 level will be significant support as it was previous resistance. Furthermore, the 50-day EMA continues to offer support underneath and it is starting to cruise to the upside. This shape of the candlestick is very negative, but at the end of the day I do not think it means much over the longer term.

The market closing at the very bottom of the range for the trading session does suggest that we have a little further to go to the downside, so I think we may retest the 1.40 handle again. That is not a huge surprise, as we have broken above that level only to explode to the upside. Typically, that means we have to come back to test that previous resistance for support. I think that is what we will see over the next day or two, but as soon as we can see the signs of stability, I will be looking to buy this market as the British pound has been a huge beneficiary of cyclical US dollar weakness.

Keep in mind that the Federal Reserve is not going to raise interest rates anytime soon, and it is a bit of surprise that the market has behaved the way it has. Yes, the CPI numbers came in much hotter than anticipated, but at the end of the day they have already stated that they are going to let inflation run higher for quite some time in order to get through inflation that is not just “transitory”, and have even warned that we would probably see hot CPI numbers a few times this year before coming back down. Central banks around the world continue to loosen monetary policy with the exception of a few out there, with the Bank of England recently trimming bond purchasing programs. In other words, it is a very bullish thing for the British pound longer term and therefore I am looking to follow the trend, not try to trade against it.