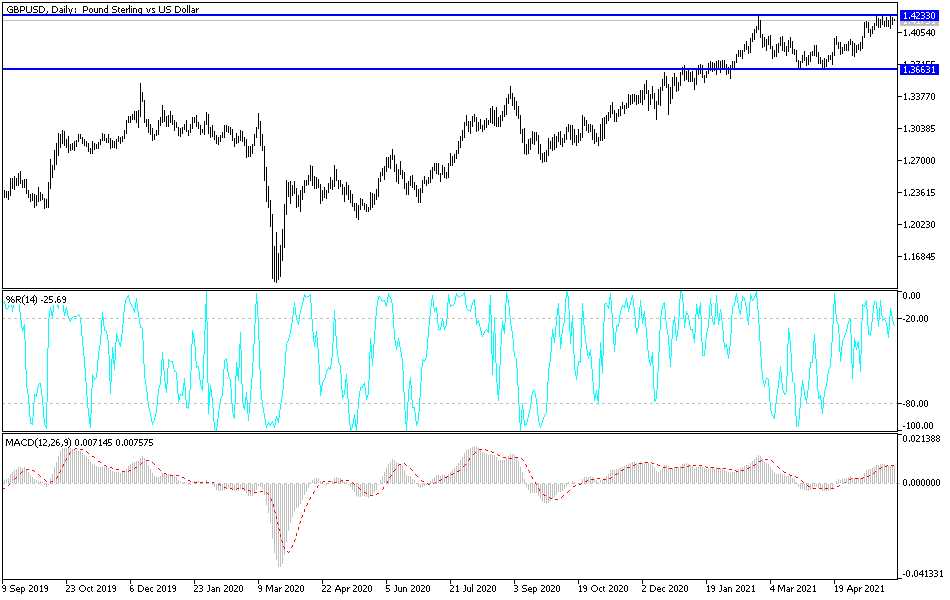

The British pound pulled back during the trading session, but turned around to reach towards the 1.42 handle yet again. It looks as if this market is trying to break out, but let us not forget that the 1.42 level has been important more than once. Because of this, I think it makes sense that we will struggle to get above here, but the one thing that I cannot help but notice is that people were more than willing to go long of the British pound not only over the weekend, but a major holiday in the United States.

With this being said, if we can break above the shooting star from February that reaches just above this area, that could kick off a fresh wave of British pound buying that would send this market towards 1.45 handle. That is what I have been waiting on for the last couple of weeks, and it is worth noting that the Thursday candlestick closed at the top of the range, much like the Friday candlestick looks like it will do. Whether or not there was a lot of volume, nobody really knows; but at the end of the day, we are in an uptrend and pressing this major resistance barrier, so I think it makes sense that we would see follow-through sooner or later.

To the downside, it looks as if the 1.41 level is going to be supportive, and most certainly the 1.40 level will be, as it is a large, round, psychologically significant figure, and the scene of the most recent breakout. Market memory would keep that somewhat important, and then we have the 50-day EMA drifting into that area as well, so I think it is only a matter of time before traders will look at that as an important level and an opportunity to pick up British pounds “on the cheap.” Beyond that, keep in mind that the US dollar is on its back foot and, with all of the printing and monetary shenanigans going on in America, it should not be a huge surprise at all to see the greenback lose strength against the British pound, which represents an economy that is coming out of the lockdown restrictions.