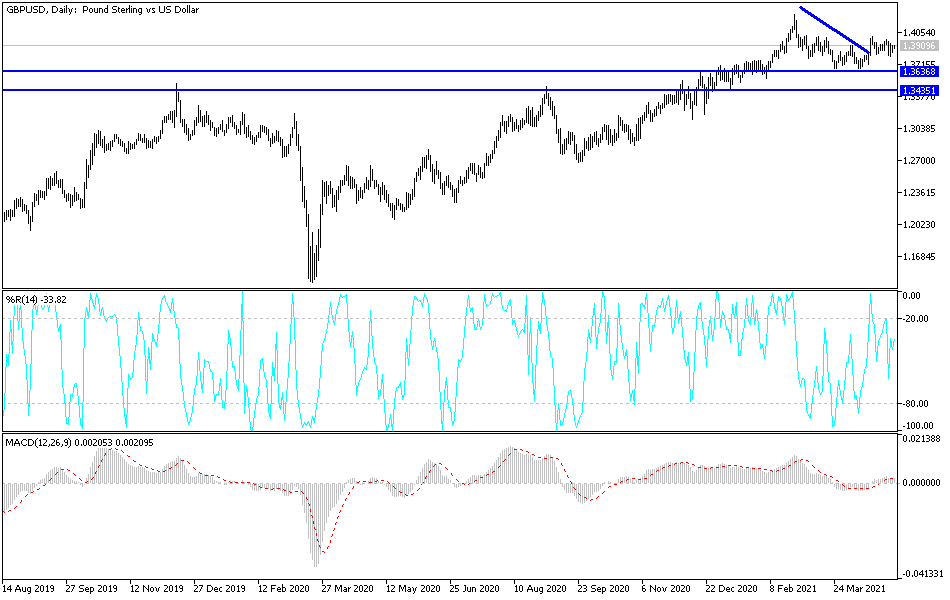

The British pound fell a bit during the trading session on Tuesday but found buyers underneath to keep the market somewhat afloat. The 50-day EMA appears to be offering a bit of support, so it does suggest that perhaps we are ready to go higher. The shape of the candlestick is a bit of a hammer, so I would not be surprised at all to see dips continue to get bought into. Furthermore, the 50-day EMA has been widely followed by the market as of late so again, I do not think it is a huge surprise.

Even if we broke down below the 50-day EMA, I see plenty of support that extends down to the previous downtrend line and the 1.3750 level, followed by the “double bottom” that had formed previously. The candlestick does suggest that there are plenty of people out there willing to get involved, and we have been in a big uptrend for some time. It is just the last couple of months that we have been somewhat sideways, as perhaps the market needs to work off some of the “froth” of the shot higher.

You should also keep a close on eye on the US dollar in general, because if it continues to lose strength, that could give you reason enough to think that this market is going to go higher. The 1.40 level is an area that has offered significant resistance previously, and I do think that we are simply trying to build up enough momentum to finally break through there. If and when we do, then it could allow this market to go looking towards 1.42 handle, where we had seen a significant amount of resistance previously. Breaking above that then opens up the possibility of a move to the 1.45 level, which is an area where we have seen a lot of movement previously as well. This remains a “buy on the dips” type of situation and I do not see that changing anytime soon. With that in mind, I think what we are looking at is the market simply trying to build up enough momentum to continue the longer-term uptrend. Granted, the United Kingdom has its own issues, but at the moment it appears that the United States dollar continues to be sold off every time it shows signs of strength.