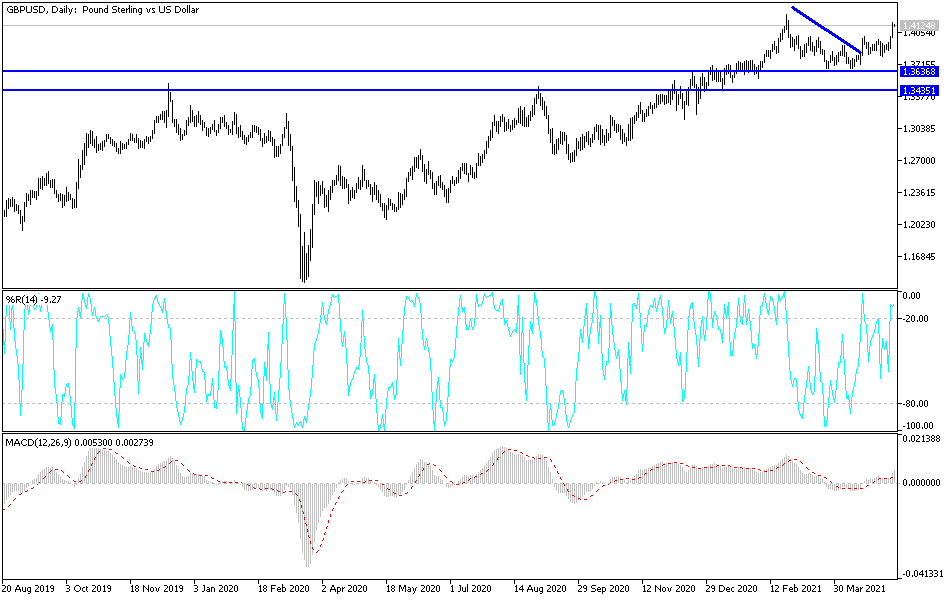

The British pound broke significantly higher during the trading session on Monday, as we have finally cleared the crucial 1.40 level on a daily close. In fact, we have exploded to the upside to show real strength in this market. It looks as if we are going to go looking towards the 1.42 handle, an area where we had seen a lot of resistance at previously. Now that we have pulled back to form a bit of a basing pattern and have exploded above the 1.40 handle, it looks like we are going to continue to try to take things out.

Underneath, the 50-day EMA sits at the 1.3850 level, and I believe that should offer a bit of a floor in the market. Nonetheless, we have clearly broken out to the upside and beyond major resistance, so I do think that we will continue to go higher. Short-term pullbacks will continue to be bought into, and the fact that we are closing towards the top of the candlestick does suggest that we are going to have a little bit of continuation, but whether or not we can simply break through the 1.42 handle is a completely different situation. If we do, that would obviously be a very strong sign, but I would anticipate that we need to pull back in order to build up the necessary momentum to make that move.

Underneath, I believe that the 1.40 handle is massive support, as it was a significant resistance barrier. After that, the 50-day EMA is an indicator that a lot of people will be paying close attention to. The size of the candlestick is also something that is rather impressive, so I do believe that this is the “real deal” when it comes to a breakout, but I do not necessarily think that we will simply slice through the upside. Ultimately, the market had recently pulled back to perhaps take a bit of a breather after the straight march to the 1.42 handle, and now it is clear that the US dollar will continue to be on its back foot. Because of this, I do think that it is only a matter of time before short-term traders will come in to pick up signs of support, but longer-term traders are probably hanging onto this market until we get to at least the 1.45 handle, maybe even the 1.50 level.