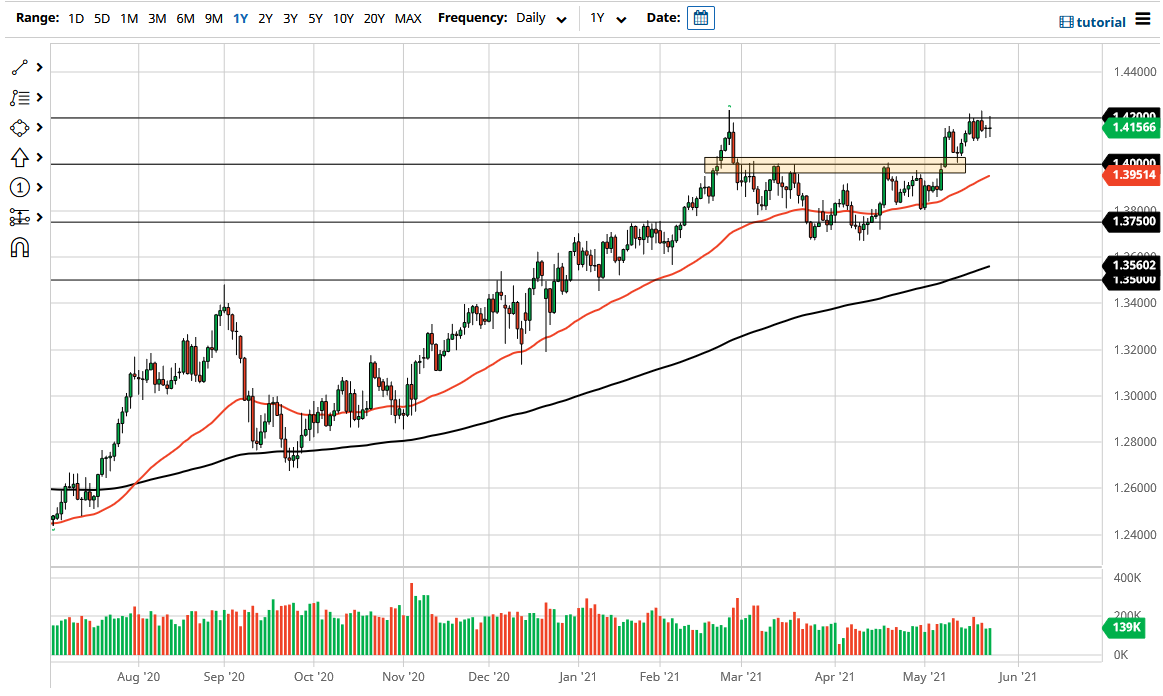

The British pound fluctuated during the trading session on Tuesday as we struggle with the 1.42 handle. That is an area that has been quite resistive multiple times, so now I think what we are simply doing is trying to “chip away” at the selling pressure. If we can finally break above the 1.42 level on a daily close, then I think that might be the signal for the British pound to take off to the upside.

To the downside, I believe that the 1.40 level should be supportive, as it was previous resistance. The 50-day EMA is starting to approach that level as well, so I think it does make sense that not only market memory but also the technical indicator would come into play on any type of dip. With this being the case, the market is likely to see a lot of choppy and noisy behavior, but I do think that you still have to favor the upside in general as we have been a very positive market. The 1.42 level being broken would open up the possibility of a move to the 1.45 handle, which is the next major figure. These big figures do tend to attract a lot of attention, so it would make sense that perhaps a little bit of profit-taking occurred there.

When you look at the chart, I do believe that there is plenty of support underneath, and I do think that a lot of value hunters will get involved. After all, the US dollar continues to sell off, and if that is going to continue to be the case, then obviously the British pound could be one of the major beneficiaries of the greenback’s bad fortune.

It is not until we break down below the double bottom near the 1.37 level that I would consider shorting this market, but if we did break down below the 1.40 handle, then I think that the market is one that you have to be very cautious with, as it is obvious that the longer-term trend has been very bullish. Therefore, we would have to assume that sooner or later there would be an attempt to hold things up. That being said, in the short term, it simply looks as if we are probably going to go back and forth.