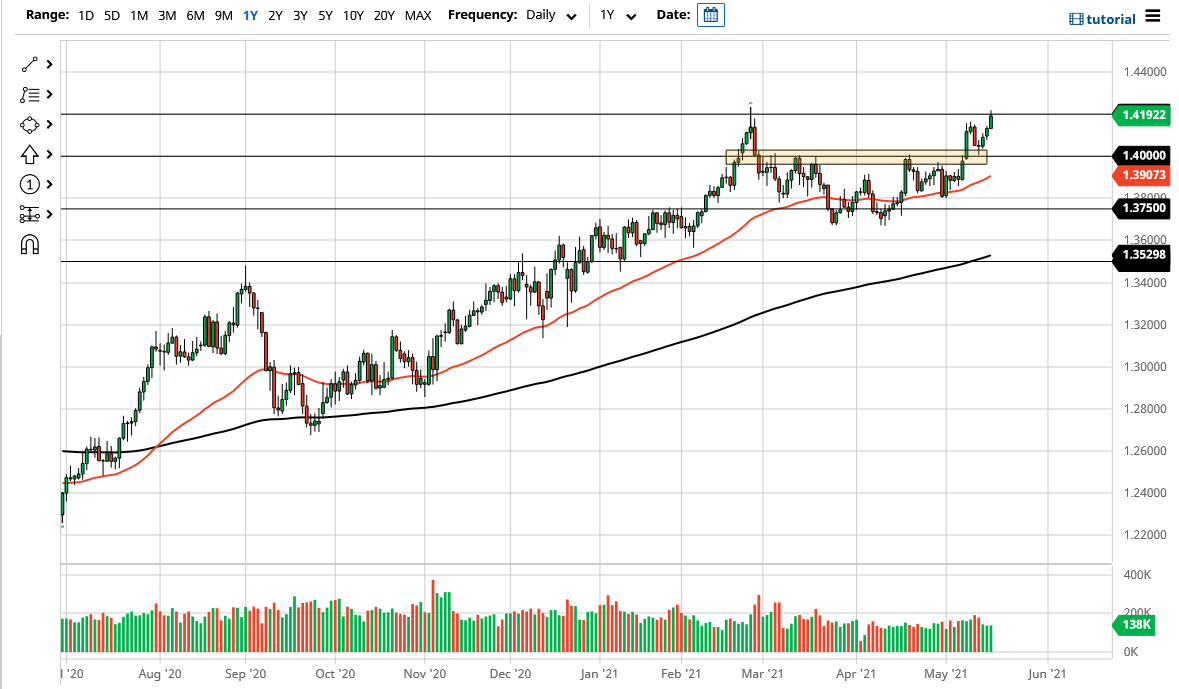

British pound traders were in a bullish mood during the trading session on Monday as we continue to see a “buy on the dips” situation. At this point, the market is likely to see plenty of value hunters as we continue to see a decision to go higher, and the 1.42 level seems to be the target. That is an area that has been massive resistance in the past, so it will be interesting to see what happens next, because if we can break above there, then it is likely that the market will go looking towards the 1.44 handle.

Looking at this chart, you can see that the 1.40 level has been important more than once, and now should end up being support. With that being the case, the market is likely to see any dip as a potential buying opportunity, and perhaps the market will see any move towards the 1.40 level as value. Furthermore, we have been in an uptrend for some time, and even though we have been going sideways for several months, it looks as if we are simply trying to build up the necessary momentum to make the next move higher. With this, I think that what we are looking at is the momentum building up in order to break out much like a “beach ball being held under water.” Once it breaks above the water, it tends to spring to life and go much higher. I think we are getting closer and closer to seeing that happen.

However, if we do break down below the 1.40 handle, then it is likely that we would have to re-assess things near the 50-day EMA and see whether or not there is going to be enough support. The 50-day EMA has been relatively resilient and reliable, so I think at that point we would need to see some type of bounce or supportive-looking candlestick. Because of this, I think there is a “buy only” type of trading when it comes to sterling, as the UK economy will continue to build up the case for a stronger British pound. The US dollar itself is under threat, so I think in general this is going to be a market that eventually finds its way towards the 1.45 handle.