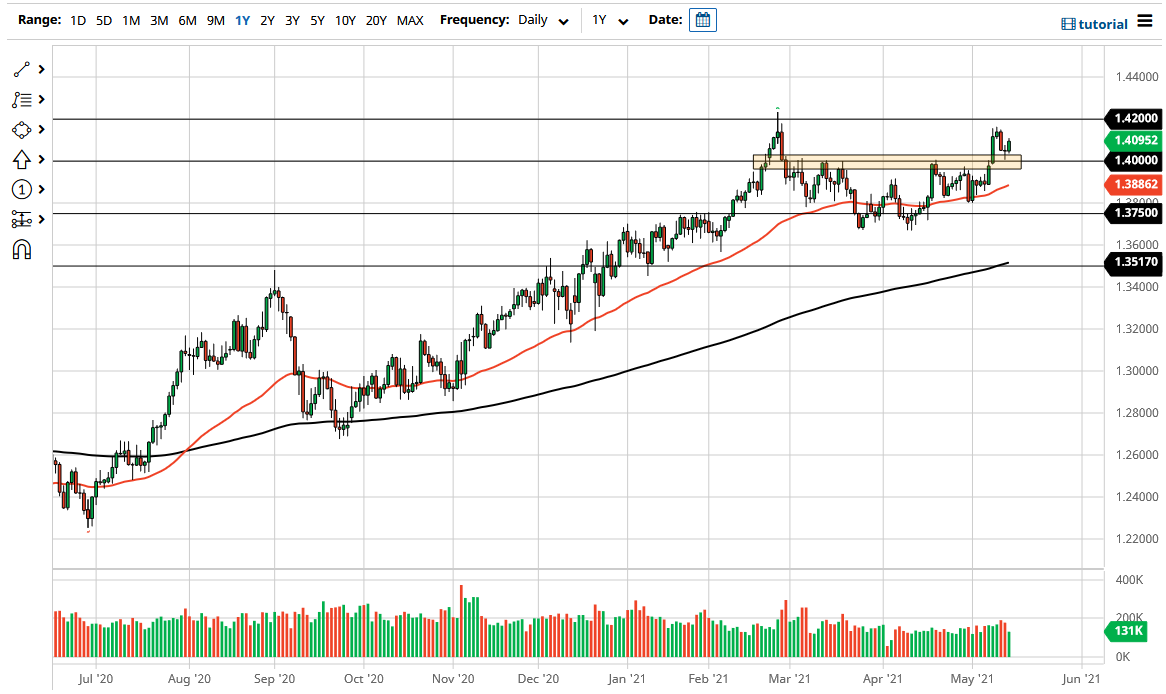

The British pound has broken above the top of the Thursday hammer to show continued upward pressure, as the 1.40 level has offered significant support. The 1.40 level is an area that has been resistance in the past, and now we have even broke out above there, only to pull back and retest it on Thursday, and then confirmed on Friday. The question now is whether or not we can break above the 1.42 handle, as it has been so crucial.

If we do break above the 1.42 handle, then it is likely that the market could go much higher, with the initial target being the 1.45 level, which has been important on the longer-term charts and of course is a large, round, psychologically significant figure that would attract a lot of attention. When you look at the chart, we have recently seen a bit of a pullback, which makes sense considering that the market had gotten far ahead of itself. With this being the case, the market is likely to see a lot of noise, but I do think that eventually the overall attitude takes over and will continue to go much higher.

Looking at the pair, it is obvious that the US dollar is on its back foot, and that does make a certain amount of sense that it would propel this market higher. Furthermore, I believe that the British pound has continued to enjoy the idea of the reopening trade more than any other currency that I follow in general, as the United Kingdom had been locked down so significantly. Beyond that, the entire Brexit situation was overblown, as the United Kingdom is still very much alive. With this being the case, you have to look at the British pound as being historically cheap at this level, so it does make sense that we continue to go higher.

Part of the pullback over the last couple of days may have been due to the idea that inflation was picking up in the United States and it is possible that the markets were believing that the Federal Reserve is going to have to tighten monetary policy, thereby driving up the value of the greenback. Some semblances of reality has come back into the marketplace, and we have seen the US dollar fall due to the fact that the Federal Reserve has stated multiple times that they are going to stay loose with monetary policy, and it now seems as if the market is trying to reprice that back into the picture.