EUR/USD tested 1.2260 resistance level due to improving economic data results in Europe, its highest in more than four months. The pair is sticking to its strong gains, awaiting the announcement of the IFO Business Climate Index Reading. The euro quickly rebounded after Christine Lagarde, president of the European Central Bank, gave short notice to suggestions that Frankfurt may look to scale back its pandemic-inspired QE program anytime soon.

The US dollar witnessed an unexpected bullish movement against most of the major currencies at the beginning of this week's trading. There were no primary motives behind this short step. In our view, the US dollar will remain under downward pressure due to the US Central Bank's extremely cautious direction and improving global economic activity.

Commenting on the performance of the EUR / USD pair, Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, said: “The price of the euro against the dollar has returned above 1.22 in an attempt to overcome the nearby resistance between 1.2240 and 1.2250, which is the last technical obstacle to return to 2021 highs near Of the 1.2350 that were last seen in the early days of January. And above the summit 1.2243, targeting 1.2349, the 2021 high. Our long-term target is 1.2556 / 1.2619, the highest level in 2018. ”

The rise of the euro comes with the reopening of European economies from the recent closures inspired by the Corona virus, and this coincided with the rise of Central and Eastern European currencies (CEE) in addition to what has been so far a period of weakening of the dollar. Another comment on the Eurodollar was Kate Gox, Chief Forex Strategist at Societe Generale Bank, stated, “In practice, the EUR / USD level around 1.2250 is the key level that needs to be broken to encourage the bears to the dollar. The 1.2150 level is an important support in the short term, and a break of 1.20 will give the dollar bulls a real heart. ”

The European economic calendar is devoid of major events this week, and therefore the euro may take its signals from international factors such as US economic data and the dollar’s response to it. However the most important indicator for the EUR / USD forecast will be price action in China. Exchange rates, most notably USD / CNH. Chris Turner, an analyst at ING Bank said, “If we see an independent bearish move in the USD / CNH pair, the market is bidding the Peoples Bank of China (PBoC) to introduce a stronger currency to fight import prices - and the stable correlations indicate that the EUR / USD will rise. Such a move would support our year-end forecast for EUR / USD at 1.28””.

This morning, revised data from the German Statistics Agency Destatis revealed that the German economy contracted slightly more than initially expected in the first quarter due to the Coronavirus pandemic. According to the results, the gross domestic product decreased by -1.8% compared to the previous quarter in the first quarter, in contrast to the growth of 0.5% in the fourth quarter. The sequential decrease was adjusted from -1.7 percent.

On an unadjusted basis, the annual decline in GDP deepened to -4.4 percent from 2.3 percent in the fourth quarter. The rate was revised from 3.3 percent. Calendar-adjusted GDP fell 3.1% year-on-year, after a decline of 3.3% a quarter earlier. According to rapid estimates, the gross domestic product decreased by 3 percent. Compared to the fourth quarter of 2019, the quarter before the start of the Corona crisis, economic output was 5.0 percent lower, according to the statistics agency, Destatis.

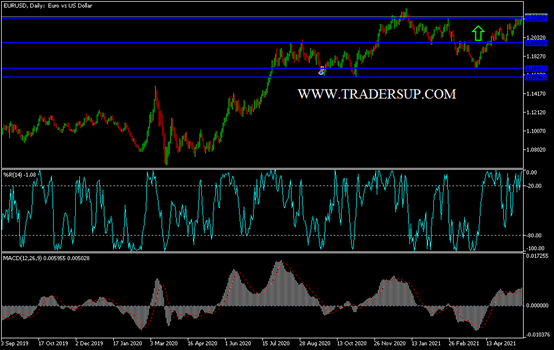

According to the technical analysis of the pair: The general trend of the EUR / USD is still up, and today's breach is important for moving towards the 1.2350 resistance level shown on the daily timeframe chart below. The euro will continue to enjoy the extent of investor appetite for risk amid improving sentiment towards reopening global economies and relative stability in Europe regarding infections and deaths from the Coronavirus. There will be no reversal of the current trend without the bears breaching the support level of 1.2000. I expect profit-taking selling at any time. Technical indicators have reached strong overbought levels.

The currency pair will be affected today by the announcement of the German IFO Business Climate reading, and from the United States of America, the US Consumer Confidence, New Home Sales and Richmond Manufacturing Index will be announced.