For three trading sessions in a row, the EUR/USD is trying to stop recent losses that pushed it towards the support level of 1.2013 before settling around 1.2030 as of this writing. The breach of the 1.2000 level will prompt the bears to control the performance. The euro has been subjected to selling against the rest of the other major currencies since the end of last week's chaotic trading coinciding with a short-term rise in US bond yields, and routine procedures at the end of the month for investors in the stock market, and ahead of holidays in Japan and China.

Therefore, the euro fell against the dollar by more than one percent and returned to approximately 1.20. Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says, “The market continues to buy immediately while the EUR/USD is above 1.1990, the high on March 11th. We are looking for gains to 1.2210 / 43, a 78.6% retracement of the movement seen this year, the February high and then the 1.2349 high in 2021.”

Bond and dollar yields rose after strong US economic data and after FOMC member Robert Kaplan repeated an already well-known but also "very hawkish" assessment that the $120 billion a month federal quantitative easing program should end soon and interest rates could rise this summer.

Kaplan will not be a voting member of the FOMC again until 2023, although he is due to address other FOMC members who are voting members to different audiences this week who also see the May nonfarm payrolls report and a set of data that the US released alongside the minor numbers from the Eurozone.

Strong economic numbers in the US may risk further increases in returns that may upset the performance of the EUR/USD. Zach Pandel, analyst at Goldman Sachs, said: “Despite the downturn at the end of the week, we believe the recent fundamental news should support further EUR/USD gains over the next two months.”

The main event for the EUR this week is ECB President Christine Lagarde's speech at 11:00 on Friday, in which she is expected to speak on the global economic outlook at the European Union's State of the Union event. Lagarde and other policy makers at the European Central Bank have recently noticed an improvement in the outlook for the Eurozone, mainly due to the increase in vaccinations against the coronavirus and signs of greater-than-expected economic resilience, so this week's speech may be an upside risk to the euro.

Seasonal effects and ECB policy aside, the US jobs report on Friday will be more important than it is given the dollar's continued sensitivity to changes in yields, but when combined with the strength of previous numbers, this could become a double-edged sword. Expectations are that the US economy, in the midst of recovery, may provide 975,000 jobs from 915,000 jobs recorded in the previous release. If the forecast is announced higher, it will be positive for investors' appetite for risk.

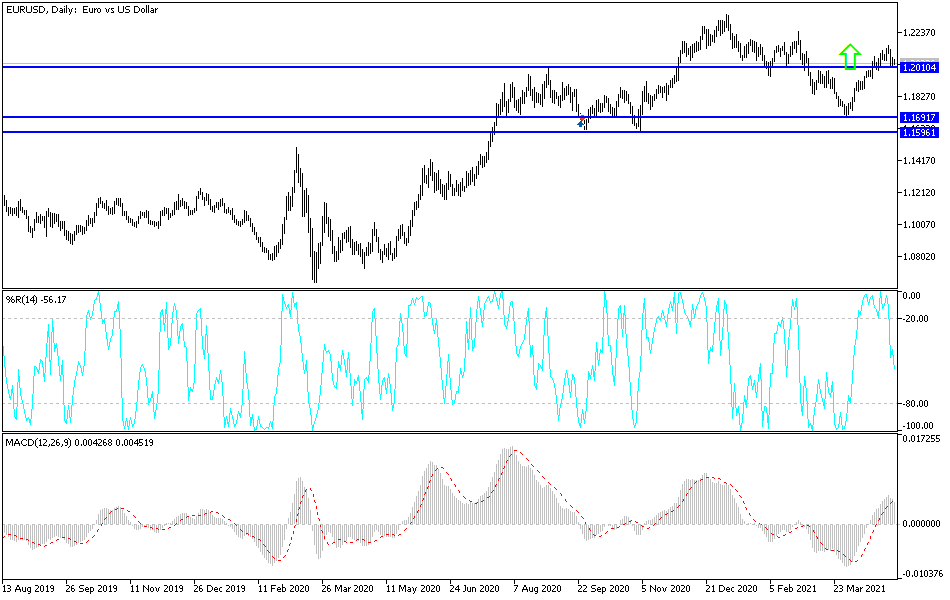

Technical analysis of the pair:

On the daily chart, the EUR/USD held on to the level of 1.2000, which still gives hope to the bulls to continue controlling the performance. In the same period of time, a move towards the support level of 1.1865 will end bullish hopes, and the bears will firmly control the general trend, which is still bullish despite the recent selling. The currency pair will return to the path of its recent upward correction if it moves towards the 1.2140 resistance again. I still prefer to sell the currency pair from every upside level in the near term.

The currency pair will be affected today by risk appetite, as well as the announcement of the trade balance figures and factory orders in the United States of America.