The positive US inflation numbers were offset by the announcement of a sharp decline in US retail sales. This contributed to a bullish close for the EUR/USD last week, which stabilized around the resistance level of 1.2147, with gains extending to the resistance level of 1.2182, its highest in two-and-a-half months. This week, the currency pair is anticipating the contents of the minutes of the last meeting of the US Federal Reserve. According to the minutes of the European Central Bank meeting, the bank may review the economic expectations and stimulus plans at the next meeting in June.

According to the recent performance, Forex analysts at JP Morgan changed their position on the US dollar and said their expectations for a stronger currency were becoming more moderate, which pushed the euro up against the dollar. They see that the US Federal Reserve Board's (Fed) steady stance on policy is being combined with improved prospects in the Eurozone on the back of “catch-up” vaccinations, pushing them to look for stronger performance in the EUR/USD exchange rate.

“Our selective bullish outlook in the USD has been challenged,” said Mira Chandan, JP Morgan Forex strategy analyst, at a regular monthly currency research briefing. The medium term outlook remains for higher US yields, and ultimately a modest decline in EUR/USD.

JP Morgan's near-term bullish stance for the dollar in the first quarter of 2021 was challenged in April and May by the Fed's continued reluctance to advance the possible timing of a rate hike for the first time.

Market pricing continues to show anticipation of the first interest rate hike by the Fed in early 2023.

For his part, Fed Chairman Jerome Powell said in the bank's briefing in April that "additional significant progress" toward employment and inflation targets is required of the FOMC before reducing quantitative easing and taking steps toward raising the interest rate. Thus, a series of massive payroll reports is needed to reverse the Fed's curve, but the US non-farm payrolls report for May proved a bitter disappointment for the dollar bulls looking for the kind of explosive reading required to do so.

The euro’s outperformance comes on the back of “improving European economic sentiment as the vaccination program in the region finally started bridging the gap between its peers and high-frequency economic data remained very good in the face of the latest set of restrictions,” commented Paul Megeesy, head of Forex research at JPMorgan.

By the end of last week, Germany said it would look to allow soon a significant easing of the rules given that the rate of COVID-19 infection in the country was dropping below the crucial 100/100k threshold.

JP Morgan raised its forecast for the EUR/USD pair for the next two quarters by one cent (Q2 now 1.19, Q3 1.18) in addition to upgrading the risk bias around their year-long bearish outlook of 1.16 from neutral to positive. Indeed, the long-term bearish theory for the euro and the dollar remains.

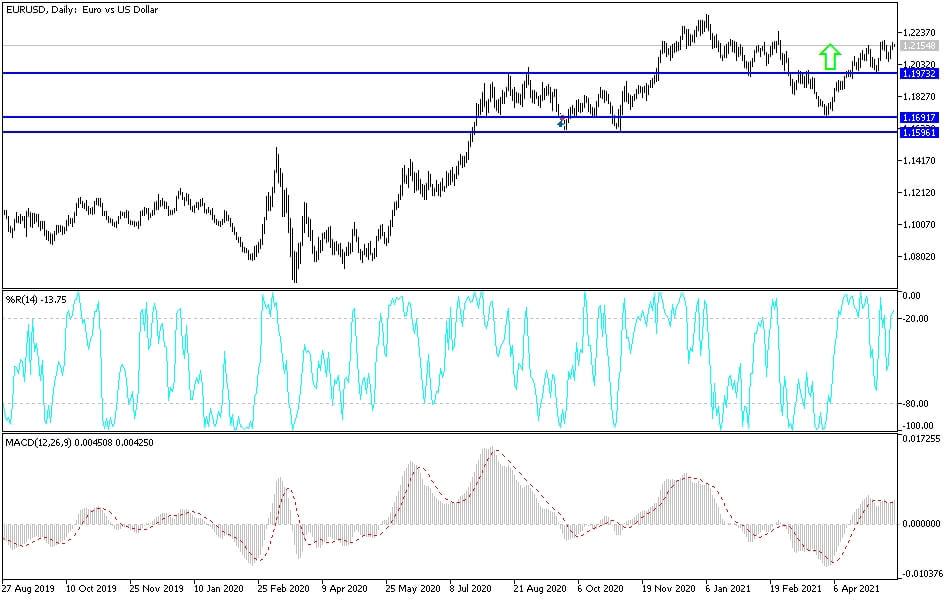

Technical analysis of the pair:

On the daily chart, the bulls dominate the performance of the EUR/USD currency pair, and a reversal of the current trend will not occur without a breach below the level of 1.2000, which is neutral between bullish and bearish expectations. The continuation of the current bullish momentum will support the currency pair's move towards the resistance levels 1.2190, 1.2255 and 1.2330. At the same time, the technical indicators will move to strong overbought levels.

Today's currency pair is not anticipating any important European economic data. From the United States, the NAHB Housing Index reading and the Empire State Industrial Index reading will be announced.