Since the start of trading on Thursday, the EUR/USD is trying to correct upwards after four bearish trading sessions that pushed the pair to the 1.1986 support level, settling around 1.2045 as of this writing. Nevertheless, the US dollar remains well supported following comments by a senior US official who warned of the need to raise interest rates in the US to prevent the US economy from overheating. The dollar rose and stocks fell after US Treasury Secretary Janet Yellen said that some “very modest” interest rate increases by the Federal Reserve may be necessary in the future.

"Perhaps interest rates should rise somewhat to ensure that our economy does not overheat, even though the additional spending is relatively small for the size of the economy," Yellen stated.

Commenting on this, Carlo Alberto de Casa, Senior Analyst at ActivTrades, said: “Janet Yellen's view on interest rates makes sense: If the economy is rising too fast and raising the risk of inflation, the Fed will likely act by raising interest rates. That shouldn't be the main news, but in the current scenario it was enough to trigger a quick sell-off in stocks and gold as well.”

The US Federal Reserve made it clear in the last week of April that it was not considering raising interest rates even as the US labor market improves dramatically. Thus, Yellen's intervention casts some doubts about the Fed's guidance, creating the necessary uncertainty for investors to sell stocks and buy dollars.

“EURUSD has quietly slid below the 1.20 pivot, indicating that risks are mounting for a further downside,” says Mark McCormick, analyst at TD Securities.

Nevertheless, Yellen appeared to backtrack her comment later on Tuesday, saying in a separate event that she was not looking to put pressure on the Fed. “This is not something I expect or recommend,” Yellen said during an online event hosted by The Wall Street Journal. "And if anyone appreciates the independence of the Federal Reserve, I think that person is me.”

The clarification helped calm previous market nerves and curbed the dollar's strength earlier.

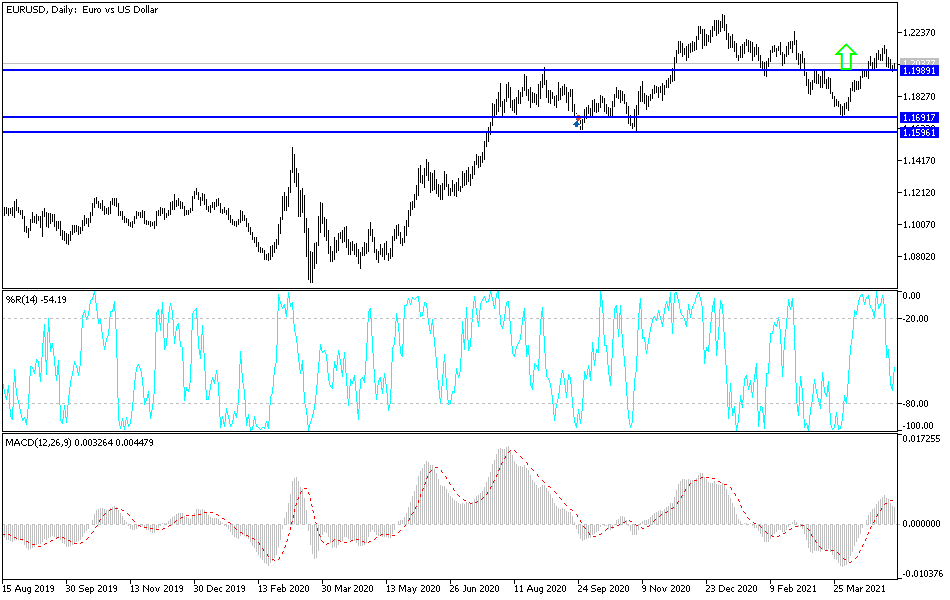

Technical analysis of the pair:

The stability of the EUR/USD above the level of 1.2000 is crucial to maintain the upward correction path, and the bulls may control the performance by testing the resistance level of 1.2150 and then moving towards stronger highs. In return, sell-offs will increase with a breach of the 1.1860 support level, and the bears will gain more control to move towards stronger support levels I prefer to sell the currency pair from every upward level.

The currency pair will be affected by market risk appetite, as well as the monthly European Central Bank report and Eurozone retail sales. These will be followed by the announcement of the number of weekly US jobless claims and the rate of non-agricultural productivity.