For three trading sessions in a row, the EUR/USD is moving in a downward correction range amid profit-taking selling. The bears moved the currency pair to the 1.2000 level. Attempts to breach below it will motivate the bears to move towards stronger support levels. The pair is stabilizing around 1.2015 at the beginning of trading on Wednesday.

The US dollar was the worst-performing major currency over the past month, yet it is the best-performing currency today, and it may be an indication that the dollar selling may face some hurdles. Commenting on the performance, Martin Miller, a market analyst at Reuters, says that one of the main factors that could be linked to the strong seasonal demand for the US dollar in May may happen again this year, and that is the strengthening of the US economy.

A Reuters study of the performance of the U.S. Dollar Index (DXY) for all of May since 2000 shows that it has risen in 13 of the past 21 years, or 62% of that time. Accordingly, analysts believe that the purchase of the dollar in May appears to coincide with the recovery of the US economy in the second quarter.

The EUR/USD exchange rate has returned to the psychologically and technically important level of 1.20, after being as high as 1.2150 in the previous week.

Focusing on Friday's US jobs report, it appears that investors will begin to anticipate an optimistic move from the US Federal Reserve much faster than expected. The Fed sent a decisive message last week that it is not in a position to begin ending the quantitative easing program (known as tapering) as their judgment was that the US labor market would need to dramatically accelerate its job creation. Therefore, if the US non-farm payrolls report exceeds expectations, investors may buy the dollar in the belief that the Fed will be forced to pull back and start running low before raising interest rates.

In the year of the COVID-19 pandemic, the European Central Bank bought 95.5% of new bonds issued by member states in the Eurozone and promised to keep them in its portfolio for long periods. Under the Public Sector Purchase Program that was launched in 2015, it has split purchases among individual states according to their shares in the ECB's equity. But as part of the pandemic emergency purchase program decided in March 2020, bonds are bought with the aim of creating favorable financing conditions for less creditworthy countries.

During 2020, European Central Bank purchases exceeded new government bond issuance by 17% in Italy and 13% in Spain. The European Central Bank did not provide an answer on how it could reduce these massive bond holdings - for example, by not reinvesting as the bonds mature - without creating pressure in the market.

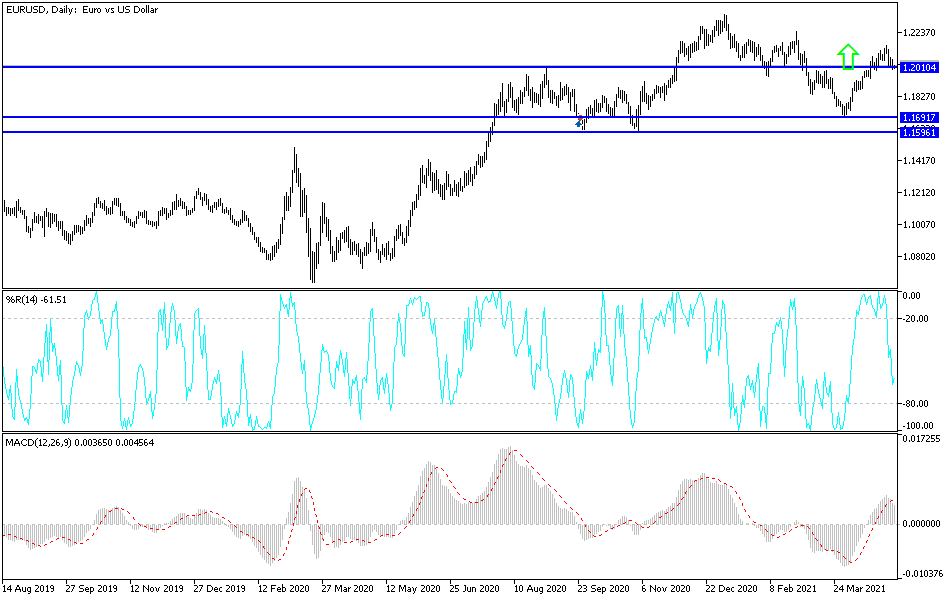

Technical analysis of the pair:

On the daily chart, the bears pushed the EUR/USD currency pair below the 1.2000 level. This will increase technical selling, which may mean that Forex investors want to push the pair down until the US jobs data results are announced. The levels of support closest to the pair now are 1.1955, 1.1880 and 1.1790. In return, the currency pair will return to the range of its bullish channel by moving towards the resistance level at 1.2145 again. I still prefer selling the currency pair from every upside.

The PMI reading for the services sector will be announced for the Eurozone economies, followed by the producer prices in the bloc. From the United States, the first edition of US jobs numbers will be announced, the ADP survey to measure the change in non-farm payrolls, and then the ISM Services PMI reading.