The recent gains of the EUR/USD pair came to a halt at the 1.2180 resistance level, a two-and-a-half-month high. The US dollar is still suffering from selloffs since the US jobs numbers were released at the end of last week. The currency pair stabilized around the 1.2145 level at the beginning of trading today, and the pair may witness strong movements once the US inflation numbers are announced. The euro gained some support after the release of the latest ZEW survey results, which confirmed that investors are increasingly confident of the prospects for a recovery in the Eurozone. The euro was higher against all other major currencies, with the exception of the Swedish krona, the Polish zloty and the Norwegian krone, within the price movement that gave the EUR/USD price a clear path towards the top of 1.22 and its highest level since late February.

This performance comes after improved economic prospects were recognized by increasing numbers of analysts in the May repeat of the survey conducted by Zentrum fur Europäische Wirtschaftsforschung (ZEW), with confidence measures in Europe and Germany rising strongly. The index, which reflects changes in expectations for the Eurozone over the next six months, rose by 17.7 points to 84.0, supported by a wave of optimism about the German economic outlook, as the index that measures confidence in expectations rose to its highest level since 2000.

Commenting on the positive numbers, Klaus Vestsen, chief Eurozone economist at Pantheon Macroeconomics, says: “The jump in expectations indicates that markets now believe in the best of the worlds possible; that is, the strong economic recovery, albeit short-lived, is about to start, driven by a wonderful boost from the vaccine in the second quarter, and policymakers will not wait for the economic data to pass above average during the summer and the fourth quarter.”

The ZEW survey is surveying 275 institutional investors, who are asked to assess the relative conditions and outlook for the economies of Germany and the Eurozone. Yesterday's scale results draw a line under the sharp downturn that we saw previously in April, which is largely due to the third wave of coronavirus infections that saw tight restrictions on activity across a group of European countries. It also echoes the message of other surveys from IHS Markit that the manufacturing and service sectors in Europe have returned to life in the past month.

All this comes at a time when the continent is starting to bridge the gap between itself and the United States regarding the launch of the vaccine. “We now expect the US and the European Union to reach the milestone of vaccinating 50% of the population around the same time (mid-June),” said Nicola Dacic, economist at Goldman Sachs. "This actually closes what we thought would be about a 6-week gap.”

Meanwhile, global economic growth is entering a good place, supported by US monetary policy that keeps bond yields low across the Atlantic and elsewhere in the world, and in the process, boosts investors' appetite for risk. In addition, at the same time, exceptional government spending for Washington is helping to drive a revival of activity that will effectively provide the rest of the global economy with an opportunity to take off as well.

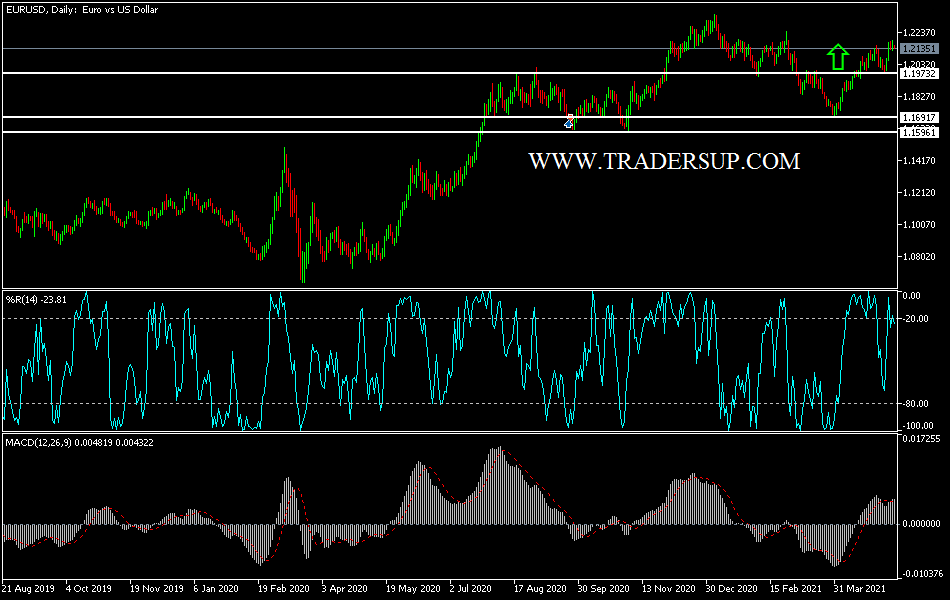

Technical analysis of the pair:

The stability of the EUR/USD pair remains above the psychological resistance of 1.2000, confirming the continuation of the bullish trend. A breach of the 1.2200 resistance may increase buying and strengthen the current trend. At the same time, the technical indicators will have an opportunity to move towards strong overbought areas. Profit-taking may be triggered at the resistance levels of 1.2190, 1.2255 and 1.2330. In return, it will be the first reversal of the trend, with the bears in the currency pair moving below the support level of 1.1990.

The market will likely react to the German and French Consumer Price Index reading, European Union economic expectations and the industrial production rate for the Eurozone. From the United States, the US CPI and the comments of some US Federal Reserve officials will be announced.