This week is an important one for the Forex industry, beginning with the Memorial Day holiday weekend and ending with the US jobs report on Friday. In advance of this, the EUR/USD currency pair is still within the range of its ascending channel, which pushed it towards the resistance level of 1.2266, its highest in four months. At the end of last week’s trading, the pair profit-taking in light of the dollar's recovery amid better-than-expected US economic data, reaching the 1.2132 support level before settling around the 1.2195 level at the beginning of this week's trading.

US personal income for the month of April exceeded expectations (MoM) of -14.1% with a change of -13.1%. The core PCPI also beat expectations (y/y) at 2.9% by 3.1%. On a monthly basis, the index matched expectations of 0.6%, while the Chicago PMI for May exceeded expectations of 68 with a reading of 75.2. The US Consumer Sentiment Index from the University of Michigan was in line with estimates of 82.9. Personal spending for the month of April was 0.5%.

From the European Union, the business climate for May improved to 1.5 compared to the previous reading of 1.12. Consumer confidence also came in higher than expectations of -8.1 in the previous period after matching expectations of -5.1. But more importantly, recent ECB speeches have indicated the possibility of diminishing business. Reports emerged this week that the European Union may be planning to reduce quantitative easing.

Commenting on the performance of the EUR/USD pair, analysts at Westpac Bank said they are now buyers of the EUR/USD due to the depreciation of the exchange rate in the wake of the French GDP figures. The EUR/USD exchange rate was seen trading as low as 1.2170 before the weekend, achieving the entry target requested by Westpac at 1.2175. The decline in the euro was partly driven by disappointing data out of France, says Richard Vranulovic, an analyst at the bank.

"The rapid increase in the release of vaccination helps to reopen the economy faster," the analyst added. "Recent surveys support a strong rebound in activity in the second half of 2021 which should gain further momentum from the eventual distribution of redemption funds.”

The French economy contracted by -0.1% in the first quarter of 2021 according to a final estimate from the country's official statistics agency, ensuring the country is officially in recession in the first quarter of the year. The market was somewhat surprised by the numbers, as the initial estimate of French GDP was 0.4% growth. Sentiment toward the French economy and the euro was not helped by additional data showing that household spending fell 8.3% in April.

But the outlook for the French economy in the second half of 2021 is certainly much brighter and sentiment toward the euro is likely to remain strong, making Westpac a buyer of the euro.

Economist Samuel Abetan at ING says that the recovery is finally ready to take off in France. "The economic recovery in France should be one of the strongest in the Eurozone."

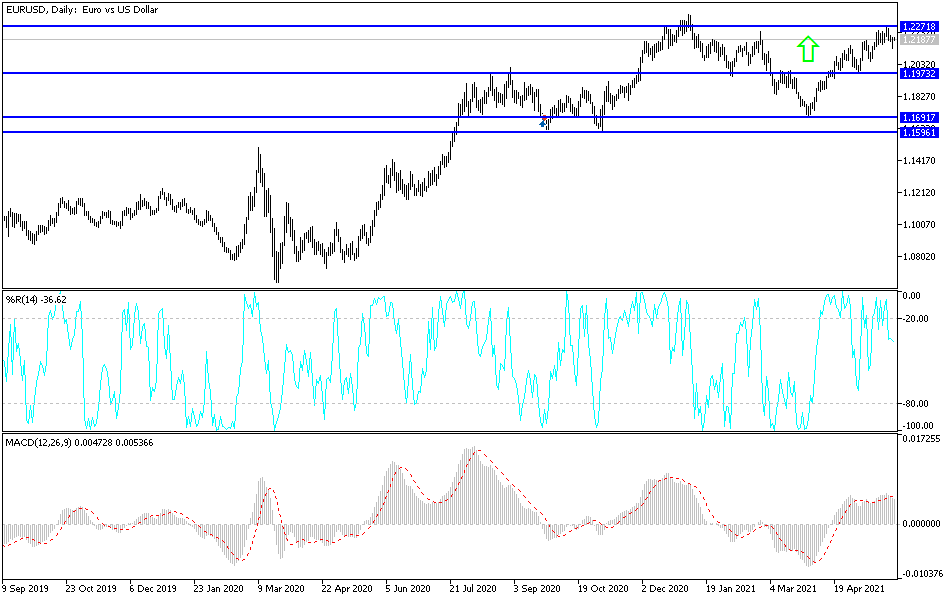

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the EUR/USD is trading within the formation of a descending channel. This comes on the heels of a slightly ascending triangle pattern. It shows a shift in market sentiment from bullish to bearish. Accordingly, the bulls will target short-term rebound profits around the 1.2209 resistance or higher at the 1.2258 resistance. On the other hand, the bears will look to pounce on profits at around the 1.2151 support or lower at the 1.2100 support.

In the long term, according to the performance on the daily chart, it appears that the EUR/USD is trading within an upward channel formation. The pair continues to trade near the overbought levels of the 14-day RSI. This indicates a significant long-term bearish bias in market sentiment. Accordingly, the bulls will target long-term profits around the 1.2346 resistance or higher at the 1.2488 resistance. On the other hand, the bears will be looking for profits around 1.2022 or lower at 1.1859.

Amid the US holiday, the focus will be on the announcement of the German and Spanish CPI and the money supply figures for the Eurozone.