Last Thursday’s EUR/USD signals were not triggered, as none of the key support and resistance levels identified that day were reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken before 5pm London time today only.

Short Trade Ideas

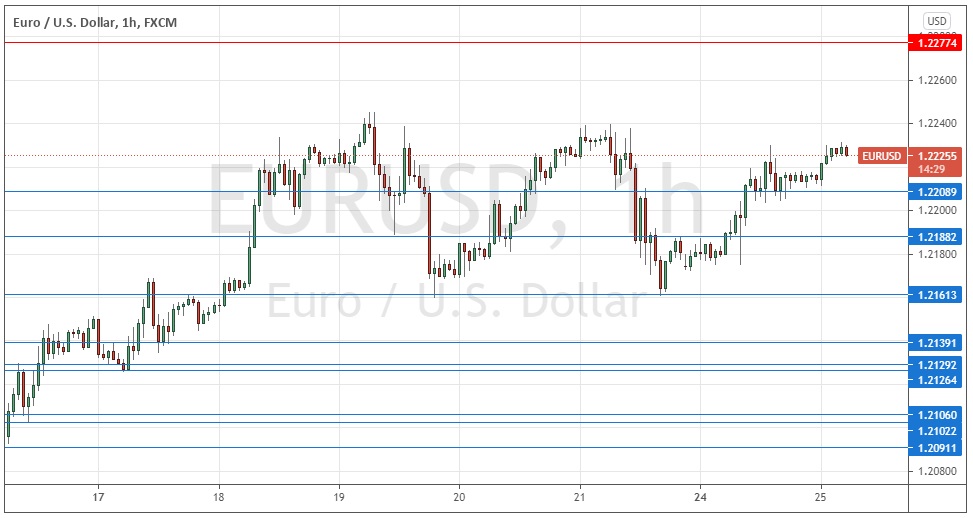

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2277.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2209, 1.2188, 1.2161, or 1.2139.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that the odds were slightly in favour of an up day today – but only slightly, as yesterday’s retracement was relatively deep. However, the price had made a short-term bullish turn that is holding up at the time of writing.

I thought that the key things to watch were the key levels at 1.2161 and the zone between 1.2188 and 1.2200.

These were good calls as the day was not only an up day, but the bullish breakout beyond 1.2200 produced some useful short-term bullish price momentum for day traders to exploit.

The technical picture now is somewhat less bullish as although the price has risen over recent hours, we see an obvious topping out for more than a week now at about 1.2240.

If the price can get established above that and the major psychological quarter-number at 1.2250, that will be a bullish sign and will likely produce an extended bullish price movement. However, if the price continues to fail to rise beyond this area, there will inevitably be a stronger downwards movement. Such a downwards move will be likely to be choppy as we have several support levels nearby which will create bullish bounces even within a wider bearish price move.

I will take a bullish bias on this currency pair today if we get two consecutive hourly closes above 1.2250.

Regarding the EUR, there will be a release of German IFO Business Climate data at 9am London time. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm.