Last Tuesday’s EUR/USD signals were not triggered, as none of the key support or resistance levels were hit that day.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken prior to 5pm London time today.

Short Trade Ideas

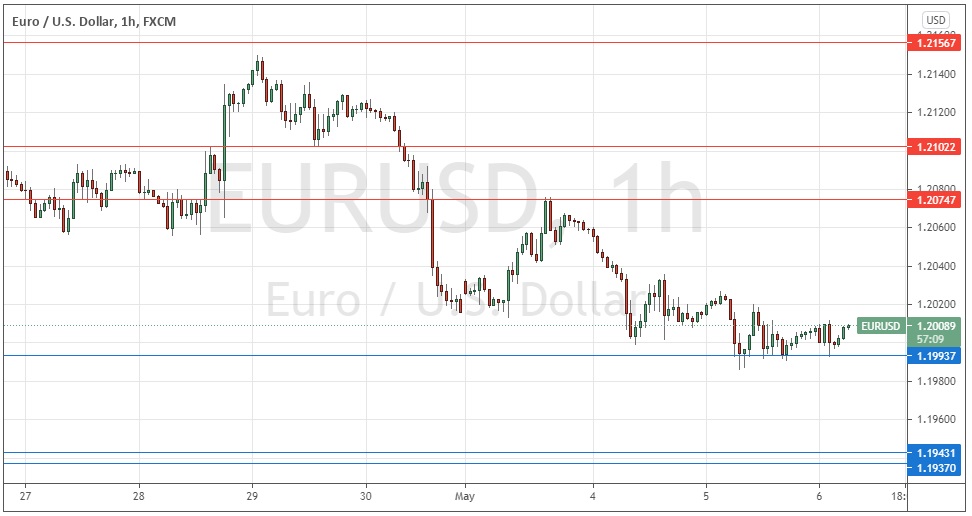

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2075 or 1.2102.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1994, 1.1943, 1.1937, or 1.1922.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Tuesday that as 1.1994 was the lower boundary of the current consolidation zone, I thought that if the price continued to fall to reach 1.1994 and rejected it quickly with a firm bullish bounce which pushed the price clearly back over 1.2000, that could be an interesting long trade, or at least a profitable scalp as the resulting bullish push might not last for very long.

This was a great call, as although this level was unfortunately not reached on Tuesday, it was hit the next day, and it continues to hold and produce bullish bounces, although they have not gone very far (as I expected). Still, this has given several opportunities for profitable long scalps from 1.1994.

The euro is weak, and the USD is strong, but there is firm support here and the longer 1.1994 holds, the more chance we will get a major bullish reversal. Alternatively, if the level breaks down convincingly, we will be likely to see strong bearish momentum that would quickly push the price down to the next support level at 1.1943.

I will be happy today to take either a long trade from a strong bullish bounce at 1.1994, or a short trade if we get two consecutive hourly closes below that level, provided the price at the entry point is far away enough from 1.1943 to give a good potential reward to risk ratio on the short trade.

It is worth noting that we will get the Bank of England’s monthly policy release today at noon London time, which could create volatility in the euro.

There is nothing of high importance due today regarding the EUR or the USD.