Bearish View

- Set a sell-stop at 1.2015 and a take-profit at 1.1925 (50% Fibonacci).

- Add a stop-loss at 1.2045 (23.6% retracement).

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.2063 (pivot point).

- Add a take-profit at 1.2130 and a stop-loss 1.2000.

The EUR/USD was little changed during the Asian session after it dropped by almost 1% on the Friday session. It is trading at 1.2022, which is about 1.05% below the year-to-date high of 1.2050.

EU and US divergence in Focus

The EUR/USD declined as recent data painted a divergence picture of the European Union and US recovery. Last week, data by America’s statistics agency revealed that the economy expanded by more than 6% in the first quarter. This growth was mostly because of the ongoing speedy vaccination process and the overall stimulus package passed by the government. In the quarter, the government passed a package worth more than $4 trillion.

On Friday, data by Eurostat showed that the eurozone economy contracted by 0.6% in the quarter. This underperformance is mostly because many Eurozone economies are still in lockdown as the number of coronavirus cases remains high. The countries have also lagged the US in administering the vaccine. Most importantly, unlike in the US, the Eurozone governments did not pass any meaningful stimulus in the quarter.

Today, the EUR/USD pair will react to the latest German retail sales. The data is expected to show that the country’s retail sales rose by 3.0% in March after rising by 1.2% in February. On a year-on-year basis, the sales are expected to fall by 0.3%. Markit will also publish the latest Manufacturing PMI data that is expected to show that the PMI rose to 66.4. Markit will also publish PMI data from other European data.

Meanwhile, from the United States, Markit and the Institute of Supply Management (ISM) will also publish the latest Manufacturing PMI data. The ISM number is expected to improve from 64.7 to 65.0 while the one by Markit is expected to rise to 66. The data comes amid surging demand for manufactured products as the economy rebounds.

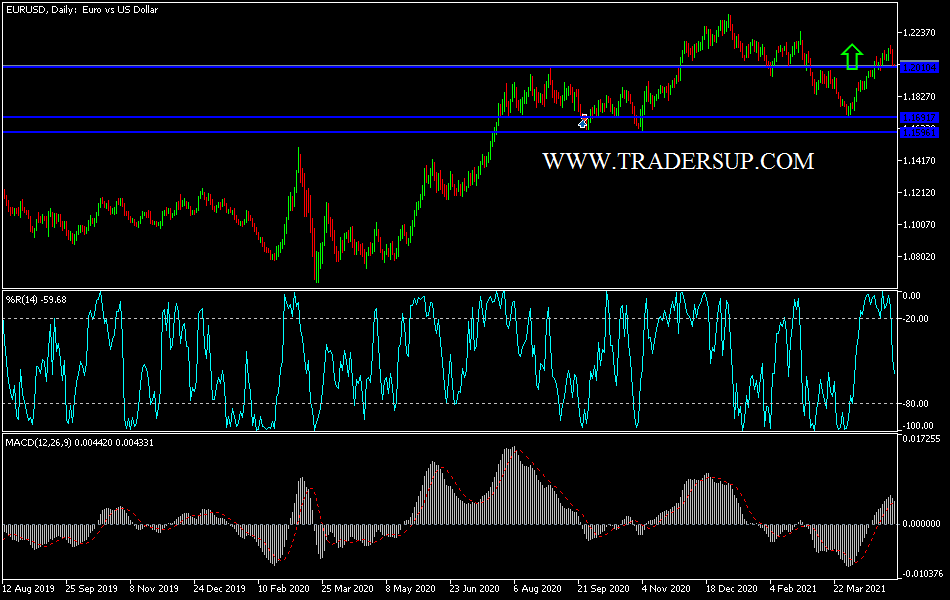

EUR/USD Technical Forecast

The EUR/USD pair declined to a low of 1.2015 on Friday. The four-hour chart shows that the pair broke out below the lower line of the ascending channel. It also declined below the 23.6% Fibonacci retracement level and the 25-day and 15-day moving averages. It also moved below the standard pivot point and is trading at the lowest level since April 23. Therefore, while the overall trend is bearish, there is a possibility of a relief rally today. If this happens, it will see the pair form the head and shoulders pattern, which is usually a bearish signal.