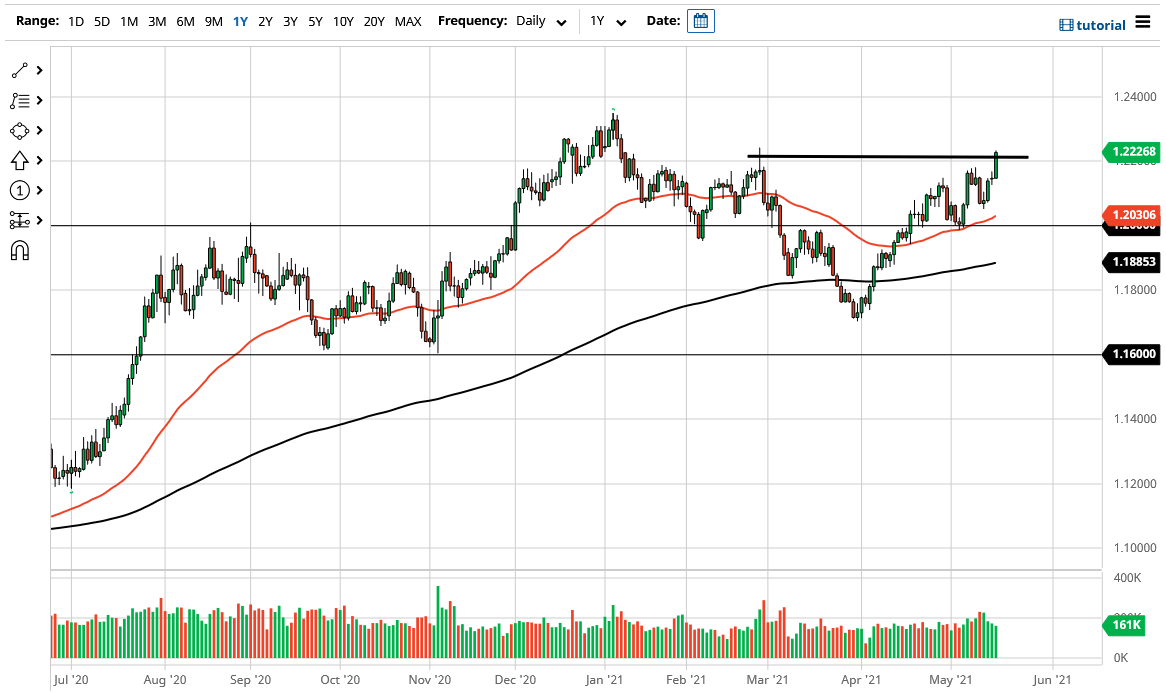

The euro rallied a bit during the trading session on Monday, as we continue to threaten the 1.22 handle. At this point, the market does seem like it will probably run into a little bit of trouble, but at the end of the day it certainly looks as if the euro is strengthening overall. With that in mind, I like the idea of taking advantage of short-term dips, as the market certainly looks as if it is going to continue to work against the value of the greenback. With that in mind, if the US dollar being threatened, this will almost certainly have a positive influence on the euro, as it is considered to be the “anti-dollar.”

When you look at this chart, you can see that the 50-day EMA is sitting just above the 1.20 handle, and it is likely that the traders out there will be paying close attention to it as the market does offer a little bit of value every time it pulls back. That being said, though, the market is likely to continue to see a lot of noise, but at this juncture it is likely that the market breaking above the 1.22 is going to be the real signal, because it will allow you to go looking towards the 1.24 handle.

To the downside, if we were to break down below the 1.20 handle, then it is possible that we could go looking towards the 200-day EMA. This is a market that should respect the 200-day EMA; but if does not, then that could lead to a massive amount of bullish pressure when it comes to the US dollar, and it would probably be like a wrecking ball for risk assets in general. This market will continue to move based upon the whims of the US dollar, and on the idea that the European Union may continue to move forward in the reopening trade. At this point, I think that the market is likely to see a lot of volatility, but given enough time, the market will be noisy yet should continue to see plenty of interest to the upside overall. I think at this point it is going to be easier to go against the US dollar and other currencies, but this makes a great indicator.